North American soybean and corn crops: conditions, weather and funds positions

Soybean crop conditions improve in the US; corn crop worsen, but remain at very satisfactory levels

The United States Department of Agriculture (USDA) weekly update on the conditions of US soybean and corn crops indicated an improvement in soybean conditions and a worsening in corn conditions in the week between July 22 and 27.

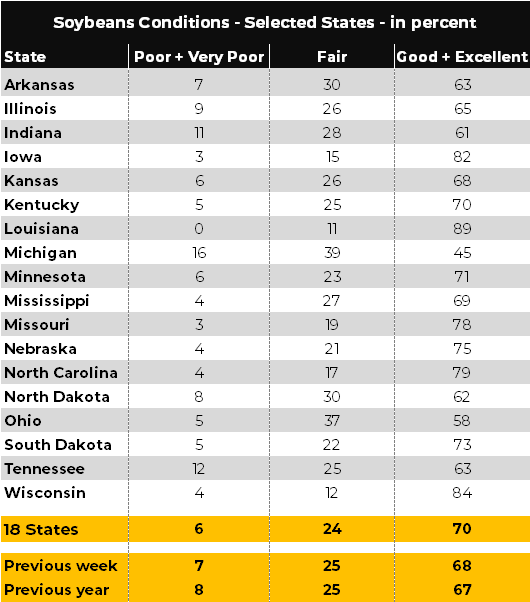

US Soybeans - Crop Conditions - in %

Source: USDA, Hedgepoint

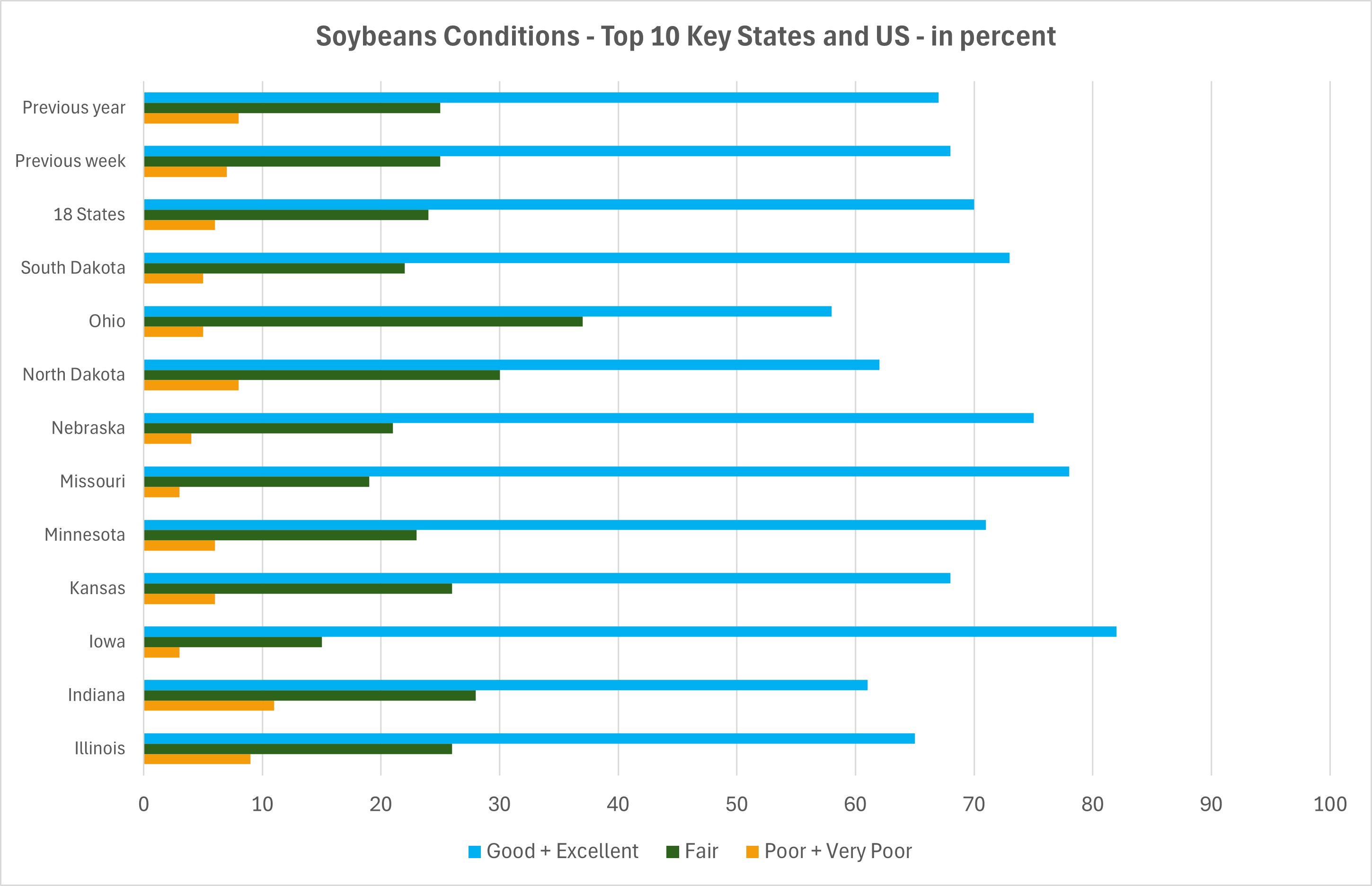

US Soybeans - Crop Conditions - Top 10 States and US - in %

Source: USDA, Hedgepoint

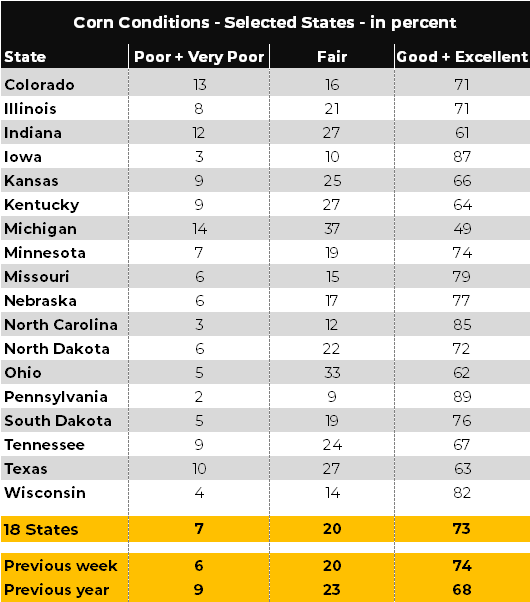

Regarding corn, according to the USDA as of July 27, 73% of crops were in good or excellent condition, 1 percentage point down on the previous week (74%). Despite the deterioration, the current rates are still well above those recorded in the same period last year (68%). In addition, the current percentage remains the best since the 2016/17 season.

US Corn - Crop Conditions - in %

Source: USDA, Hedgepoint

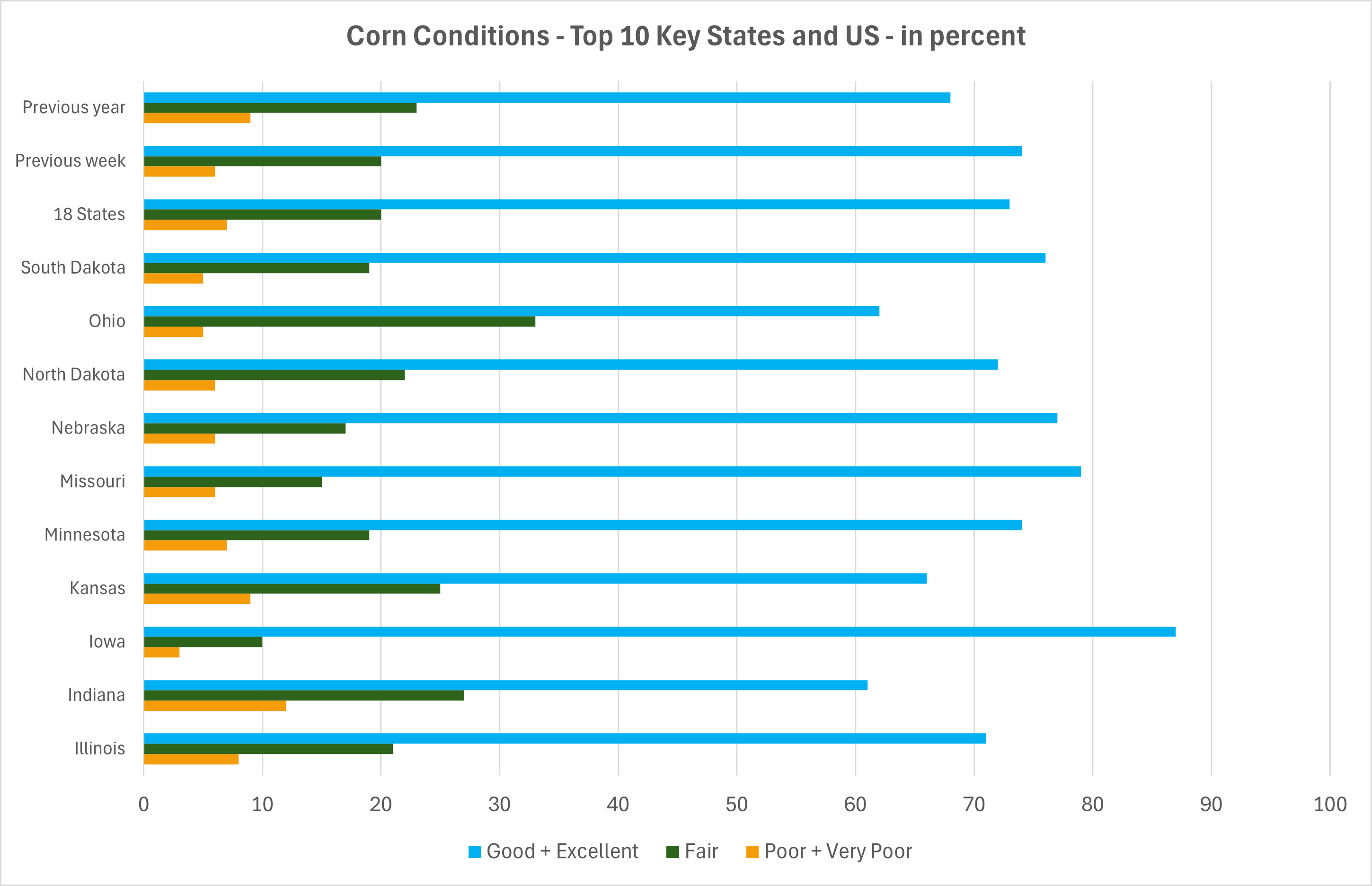

US Corn - Crop Conditions - Top 10 States and US - in %

Source: USDA, Hedgepoint

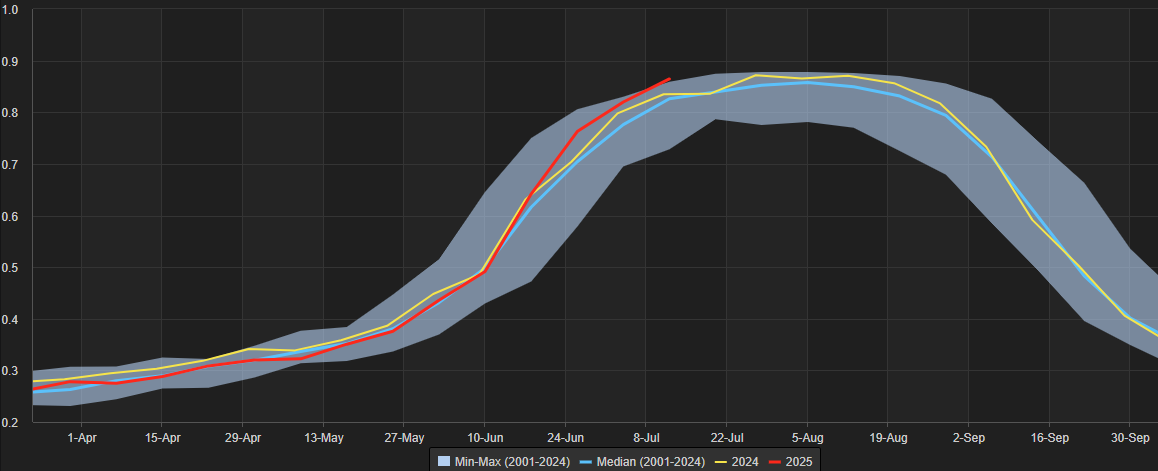

When we look at the Normalized Difference Vegetation Index (NDVI) for the US Midwest, we see that current levels point to excellent plant density regarding the previous crop and the average of the last 25 years, also indicating good crop development so far.

US - NDVI - Midwest - in points

Source: LSEG, Hedgepoint

Weather forecasts for the next two weeks

Weather forecasts for the next two weeks

The weather maps now point to a period of some moisture over much of the producing belt between July 28 and August 3. Despite this, parts of some important producing states are expected to receive little or no moisture during the period, which could lead to a less favorable environment for plant development.

Accumulated Precipitation Forecast - July 28 to August 3 - in mm

Source: NOAA

In the period between August 4 and 10, humidity should continue to affect most of the producing belt, but with little rain forecast for the Dakotas and the south of the belt.

Accumulated Precipitation Forecast - August 4 to August 10 - in mm

Source: NOAA

It is important to remember that August is a decisive month for the development of the soybean crop in the United States, and regular moisture is necessary for a good progression of the grain filling stage. Attention must be redoubled in the coming weeks, and we may see an increase in volatility in Chicago.

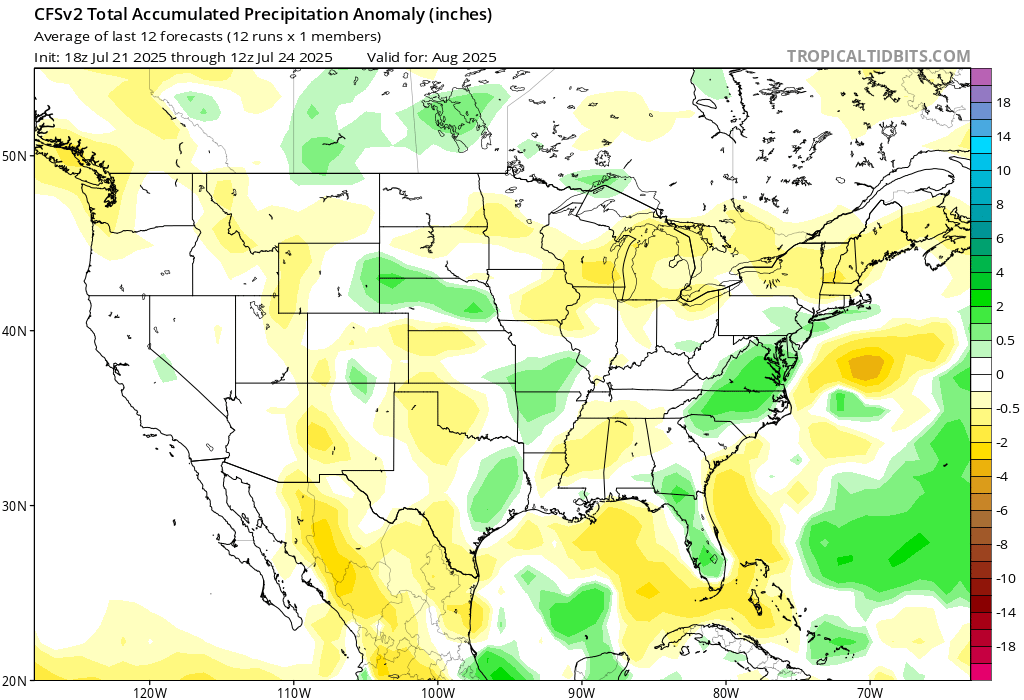

Precipitation Anomaly Forecast - August - in inches

Source: Tropicaltidbits

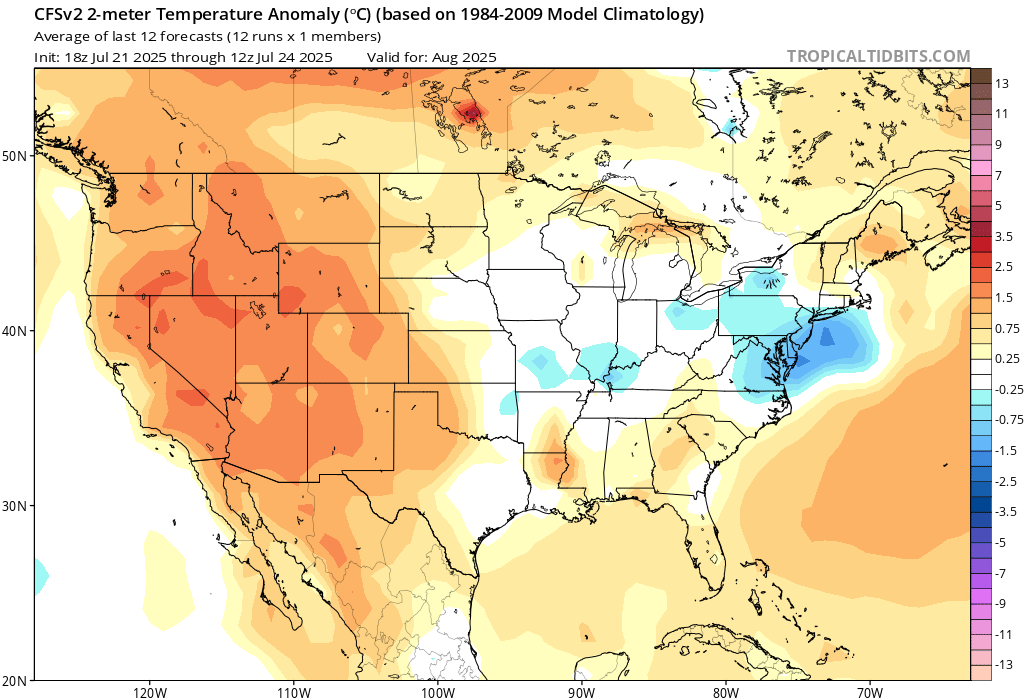

As far as the temperature forecast is concerned, the map for August also indicates temperatures within the normal range in most of the producing belt, which tends to be favorable for crops.

Temperature Anomaly Forecast - August - in ºC

Source: Tropicaltidbits

In general, weather conditions continue to point to favorable weather in the North American producing belt in the coming weeks, with no major apparent risks for the final development of the soybean and corn crops.

Funds positions

Faced with positive weather and possible full crops in the US, speculative funds continue to be net short on soybeans and corn in the US.

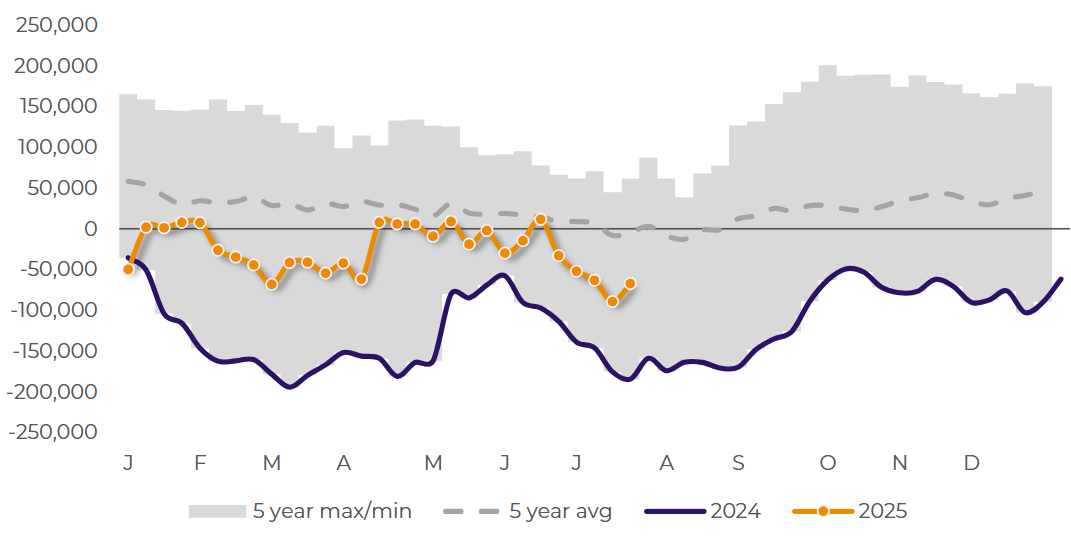

In soybean, between July 16 and 22, the funds even reduced their short positions by around 22,000 contracts, but continue with a net short position of around 67,000 contracts, which indicates some weakness for Chicago.

CFTC - Soybeans - Speculative Fund Position - in thousand lots

Source: CFTC

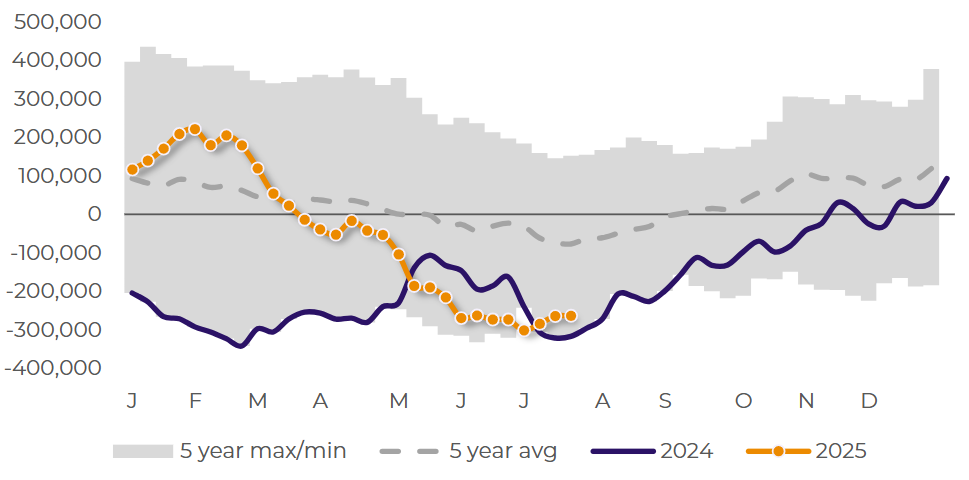

In the corn side, funds continue to bet on the sell side of the market, maintaining their net short positions since mid-April. Even with a reduction of approximately 1,500 contracts between July 16 and 22, the net short position remains at around 264,000 contracts, close to the minimum of the last five years (which also indicates weakness for Chicago).

CFTC - Corn - Speculative Fund Position - in thousand lots

Source: CFTC

Written by Luiz F. Roque

Luiz.Roque@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.