Market Call - Corn and Wheat - Highlights

Corn and Wheat Scenarios Update

Macro Overview

Macro Overview

Corn

Global Scenario

Corn

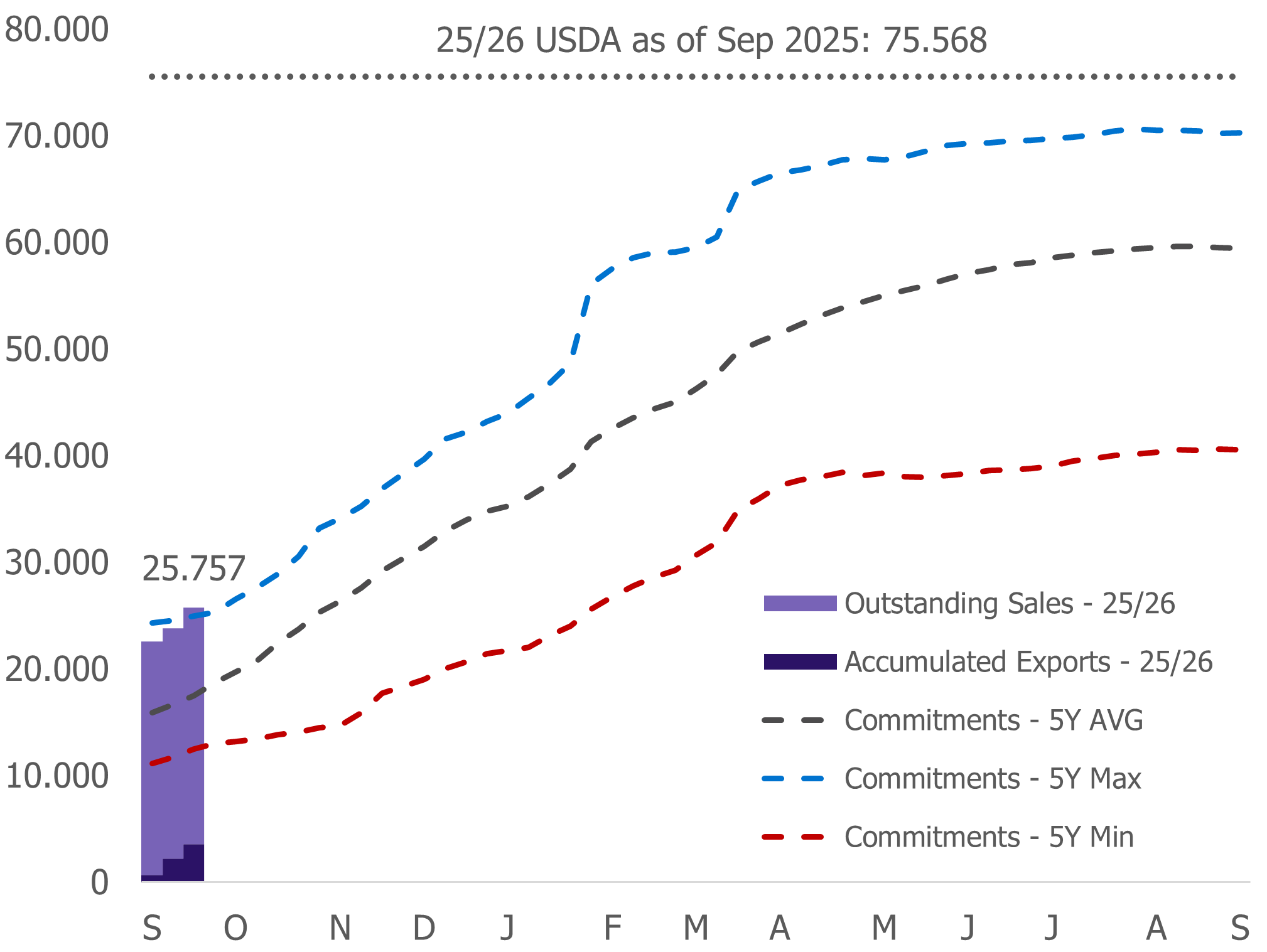

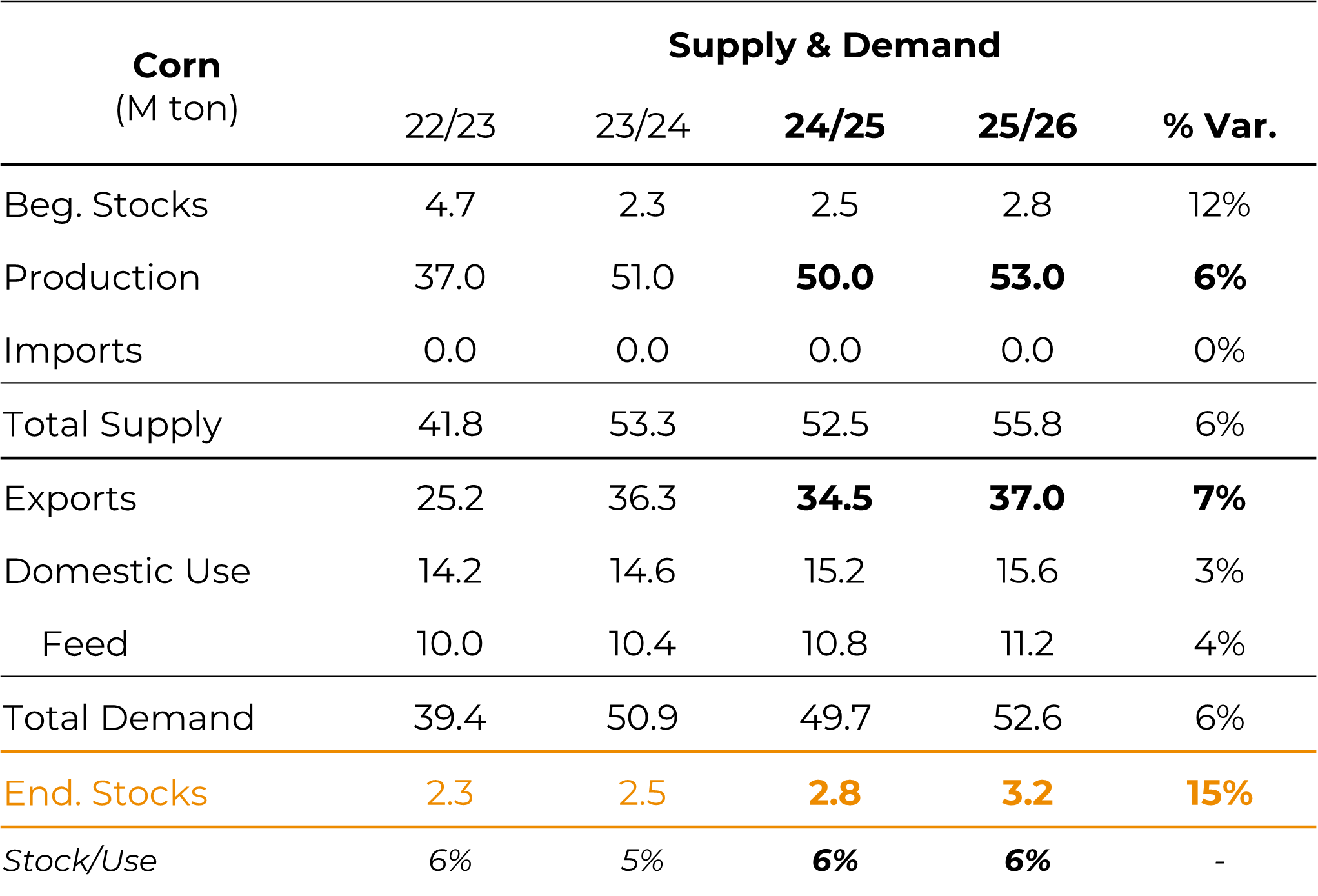

Corn - World - Supply and Demand

Source: USDA, Hedgepoint

Corn - FOB Prices - Main Origins - in USD/ton

Source: LSEG, Hedgepoint

China

China

- Demand: steady demand sustained by pig production — corn accounts for ~80% of feed.

- Stock/use: significant decline — stock/use ratio ~55%, while China historically operates close to 70%. This makes the country more prone to incremental imports if prices/trade conditions are right.

- Pig margins and slaughter: pig production margins compressed throughout 2025; slaughter rate still high → steady consumption, but buyers more selective.

- Possible trigger: a US-China agreement reducing tariffs could generate additional demand for US products.

Risk/Opportunity: lower stock/use is a recent structural factor; however, purchases will depend on the competitiveness of the corn offered (the US is currently more competitive, but still has tariffs).

Corn - China - Supply and Demand

Source: USDA, Hedgepoint

USA

USA

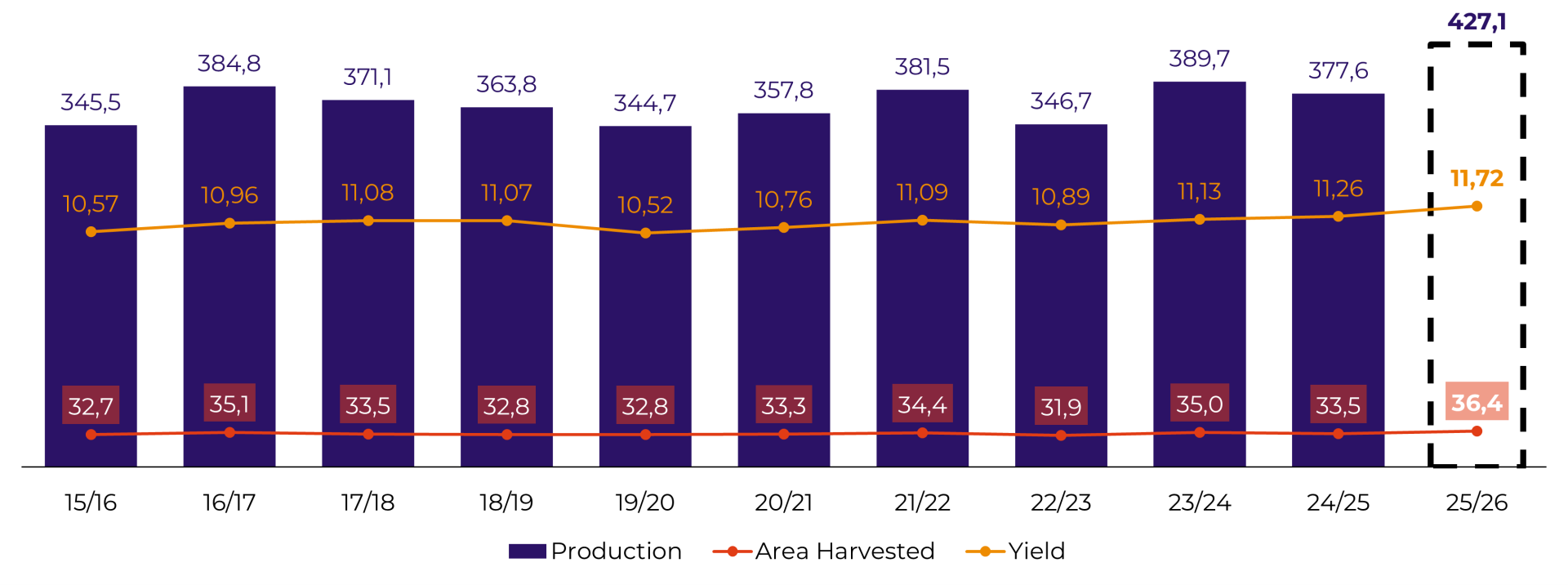

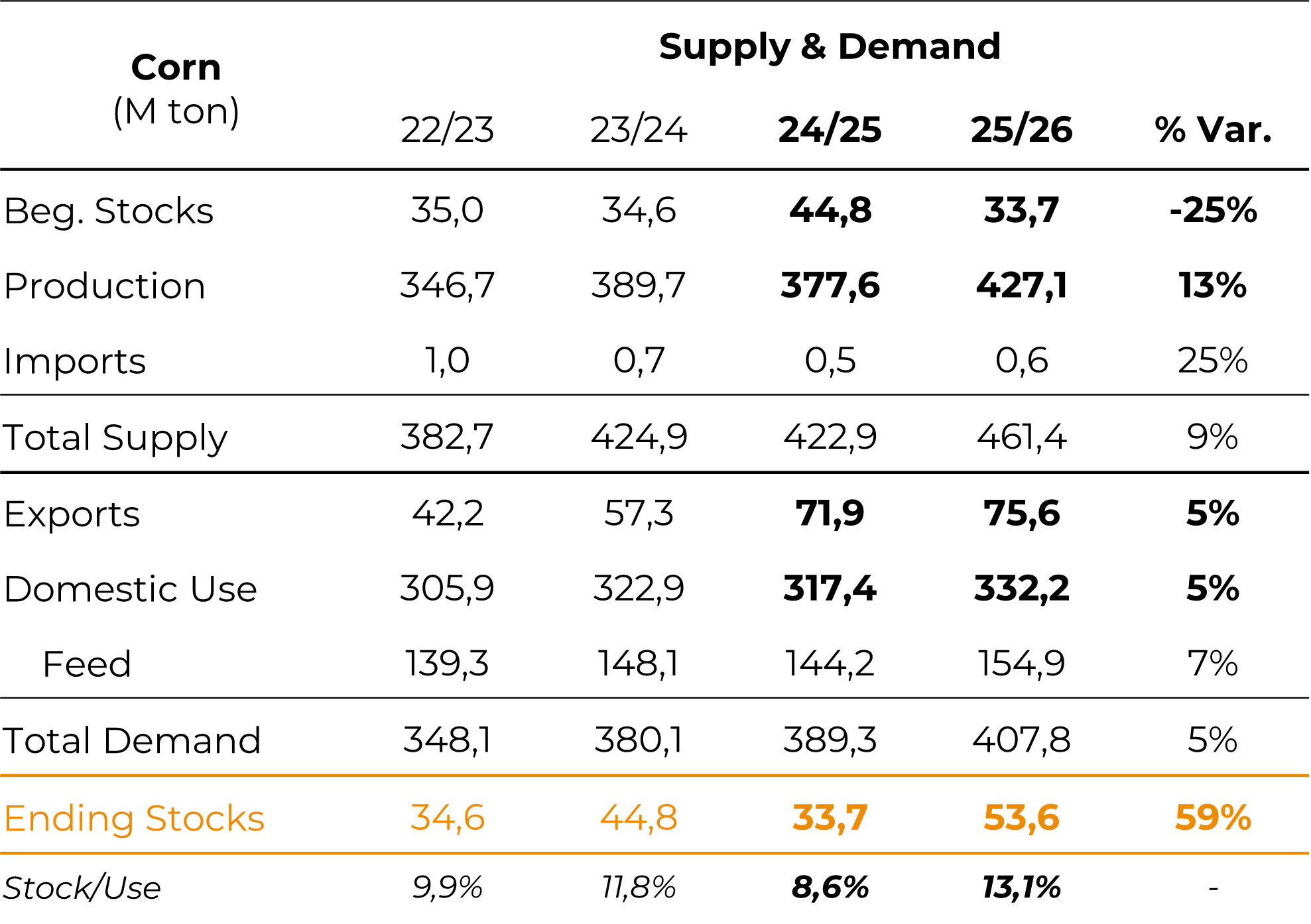

- Harvest/production: record harvest estimated at 427 Mt. There are signs that the USDA may make a moderate downward adjustment (yield slightly lower than initial estimate) when WASDE returns.

- Exports: strong pace — ~25 Mt already committed through the end of September, with the potential to reach 75 Mt in the 2025/26 season. This has supported prices despite high supply.

- Climate/harvest: harvest progressing (approximately 60% harvested at the time of presentation); forecasted rains may partially delay field work, but without risk of significant impacts.

- Impact of WASDE report: absence of WASDE creates uncertainty; new November/December figures may generate volatility.

Commercial implication: US offers very competitive corn; robust US exports are currently the main support for Chicago.

Corn - US – Production (M ton), Harvested Area (M ha) and Yield (ton/ha)

Source: USDA, Hedgepoint

Corn - US - Supply and Demand

Source: USDA, Hedgepoint

Corn - US - Export Sales - Current Crop - in M ton

Source: USDA, Hedgepoint

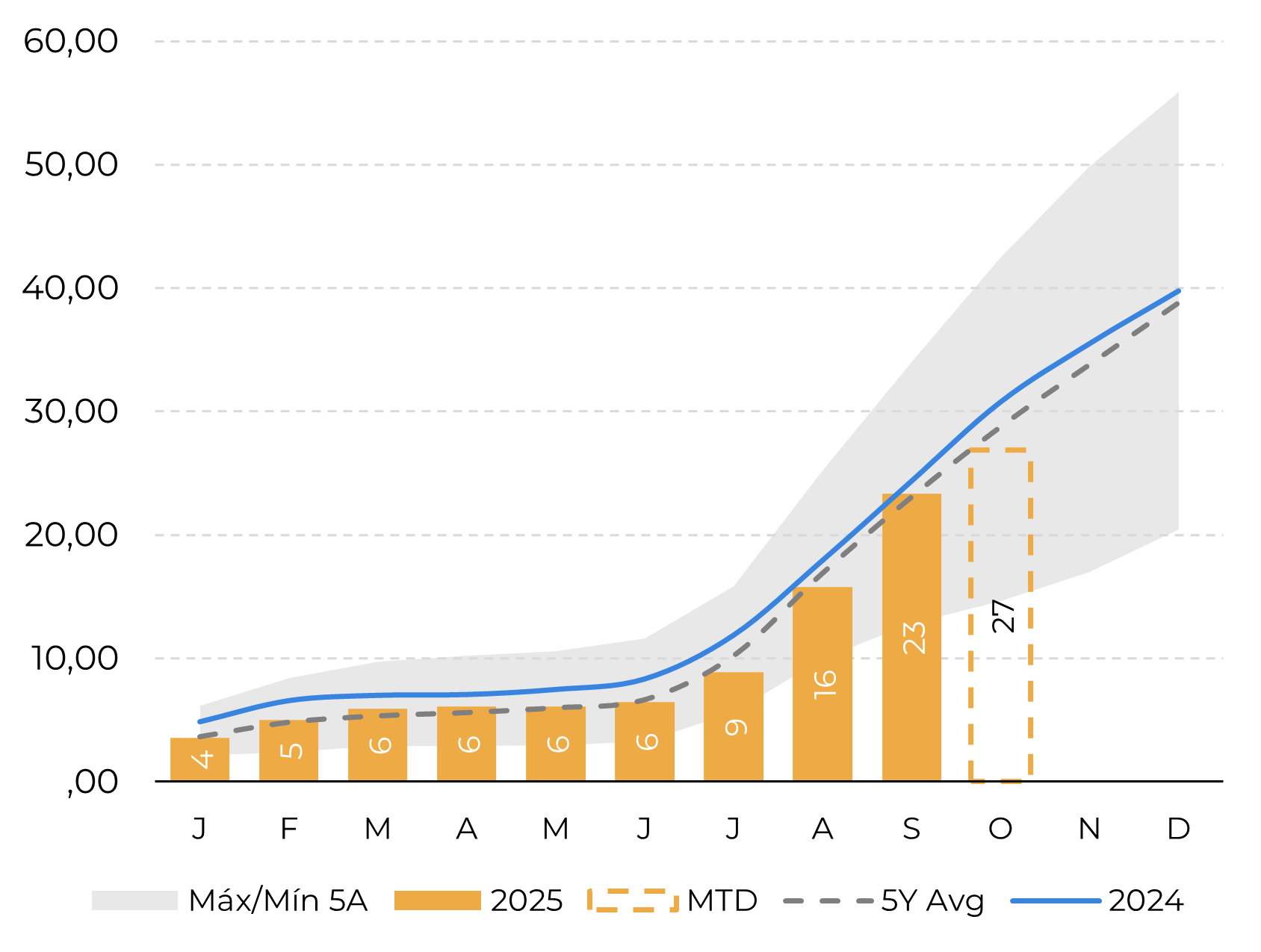

Brazil

Brazil

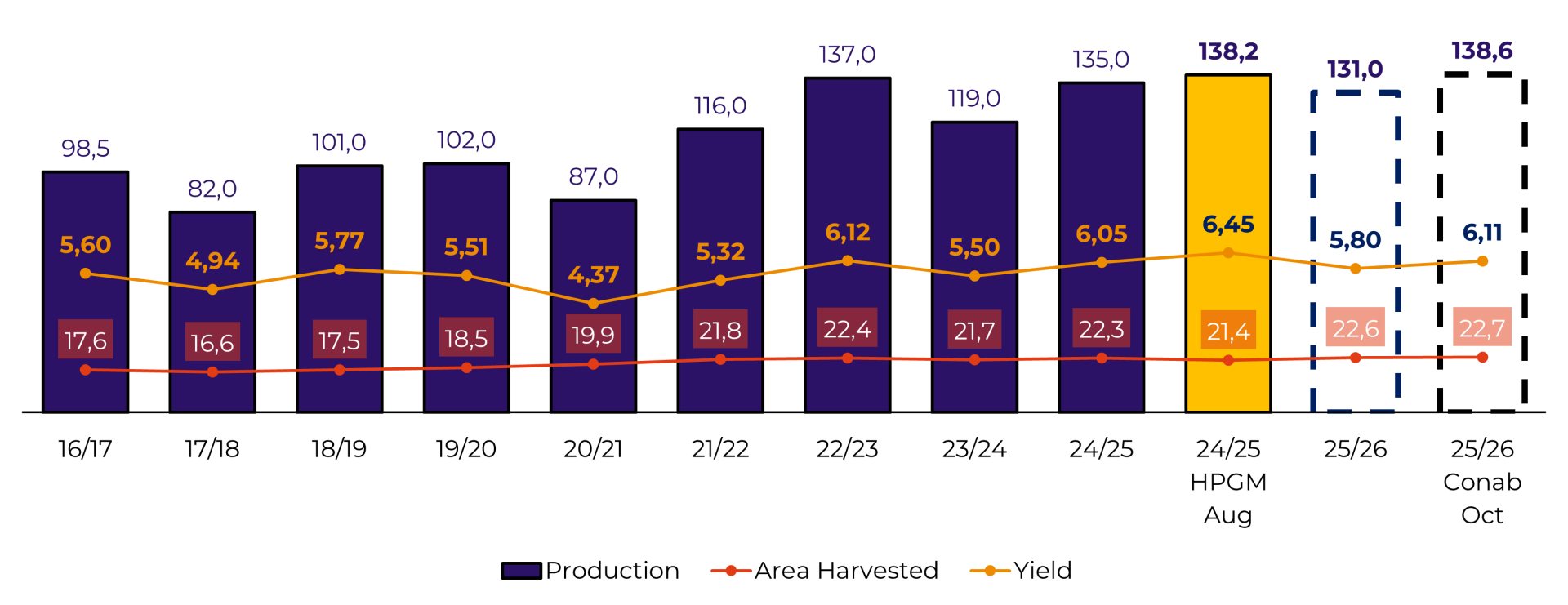

- 2024/25 harvest: estimates around 138–140 Mt (consolidated harvest).

- Target exports: 42 Mt forecast for the season: current pace and international competition make this figure challenging. At the time of presentation, Brazil had accumulated ~26 Mt in exports.

- Domestic demand: notable growth in corn ethanol — a new structural source of demand, especially in the Midwest; this sustains domestic prices and reduces local oversupply.

- Marketing and premiums: Brazilian producers sold ~56% of the harvest (below the historical average), indicating retention and expectations for better prices; port premiums are slowing down, with the Paranaguá base approaching 5-year averages.

- Weather risk: Rainfall in the South over the next two weeks may delay summer corn planting.

Implication for domestic prices: if exports do not flow, final stocks will rise and exert downward pressure; however, ethanol and domestic demand will moderate the decline.

Corn - Brazil – Production (M ton), Harvested Area (M ha) and Yield (ton/ha)

Source: USDA, Conab, Hedgepoint

Corn - Brazil - Supply and Demand

Source: USDA, Conab, Hedgepoint

Corn - Brazil - Cumulative Exports - in M ton

Source: MDIC, Hedgepoint

Argentina

Argentina

- Supply: increase in corn area (+~1 million ha) due to better margins and higher production projections — USDA 53 Mt, local consultancies up to 60 Mt.

- Retenciones and sales: temporary cut in retenciones (9.5% to 0%) generated intense sales: ~2 Mt sold in 3 days. Even with return, retenciones remain relatively low and competitive.

- Potential exports: exports could reach 37 Mt. This, added to the US, puts pressure on Brazil's export space.

- Weather/La Niña: La Niña returning → historical risk for Argentine harvest; however, maps are showing a relatively normal scenario for the next 1–2 months; chances of La Niña persisting until January (~71%) or February (~55%).

Implication: Argentina is the extra supply factor that may put pressure on Brazil's export margins and premiums; closely monitor sales pace and climate developments.

Corn - Argentina – Production (M ton), Harvested Area (M ha) and Yield (ton/ha)

Source: USDA, Hedgepoint

Corn - Argentina - Supply and Demand

Source: USDA, Hedgepoint

Argentina - Sworn Declarations of Foreign Sales - Decree 682/2025

Source: Subsecretaría de Mercados Agroalimentarios e Inserción Internacional.

Wheat

Global scenario

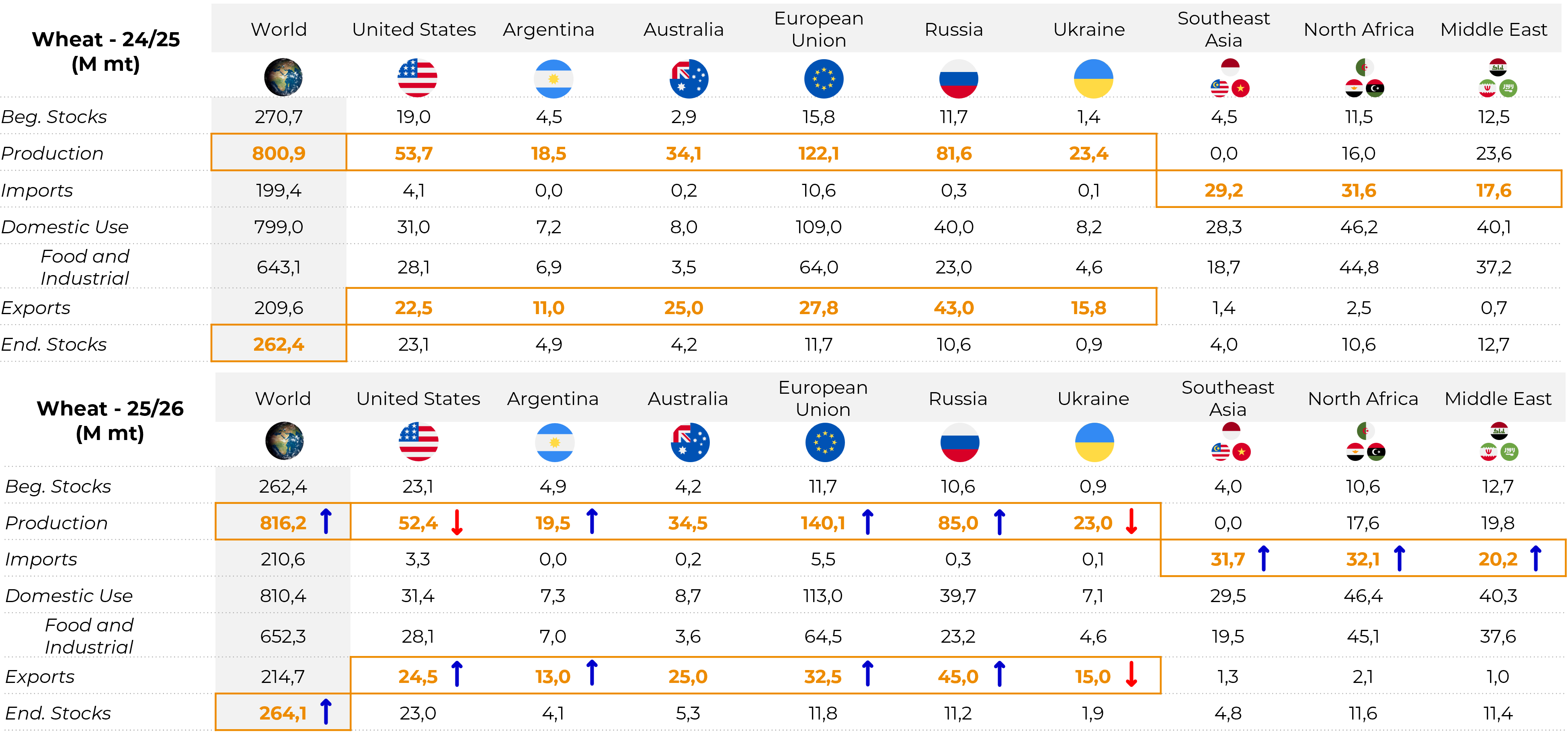

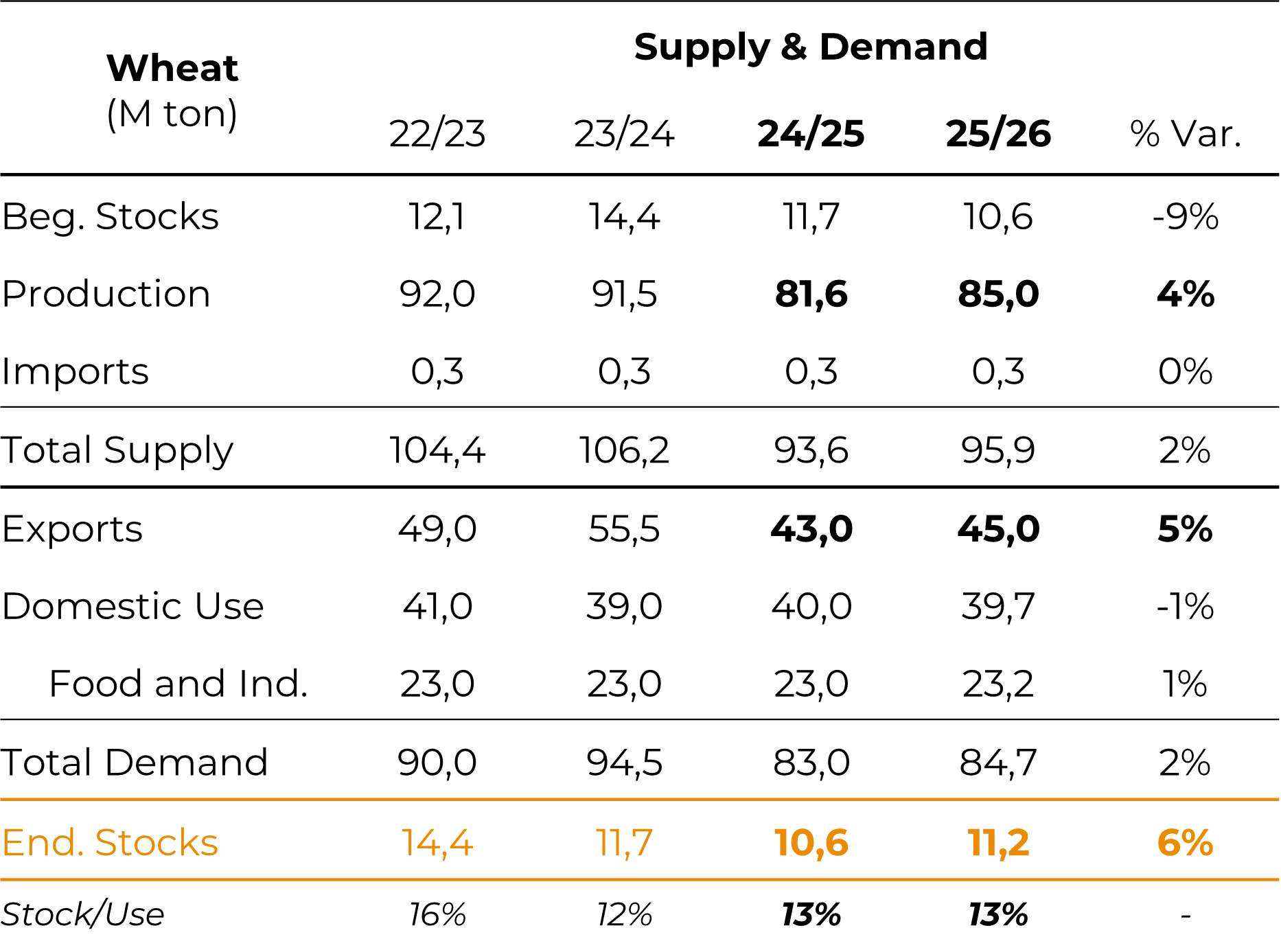

Wheat - World - Supply and Demand

Source: USDA, Hedgepoint

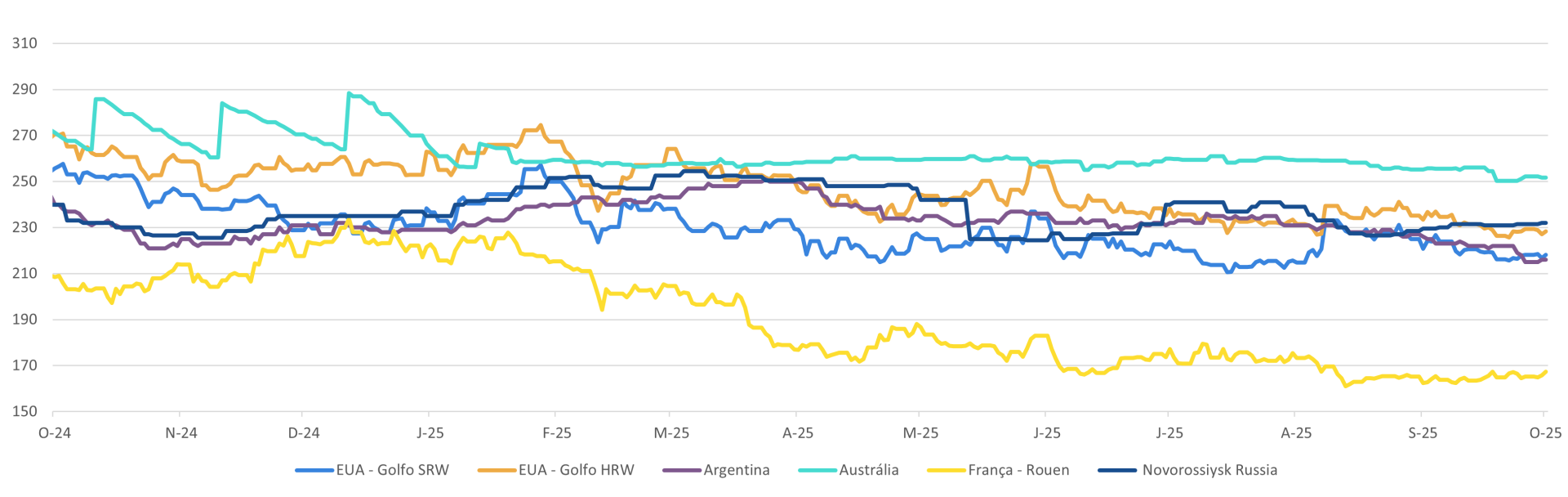

Wheat - FOB Prices - Main Origins - in USD/ton

Source: LSEG, Hedgepoint

Brazil

Brazil

- Production: downward trend in area due to worse margins; harvest estimated at 7.5 Mt.

- Import dependency: increased need for imports — Argentina is a natural and competitive supplier.

- Rio Grande do Sul: accounts for ~47% of national production; only ~10% harvested at the time of presentation; forecast rains may delay harvest, but quality does not appear to be at risk.

Implication: domestic market sensitive to Argentine flows; domestic prices will continue to be influenced by parity and exchange rates.

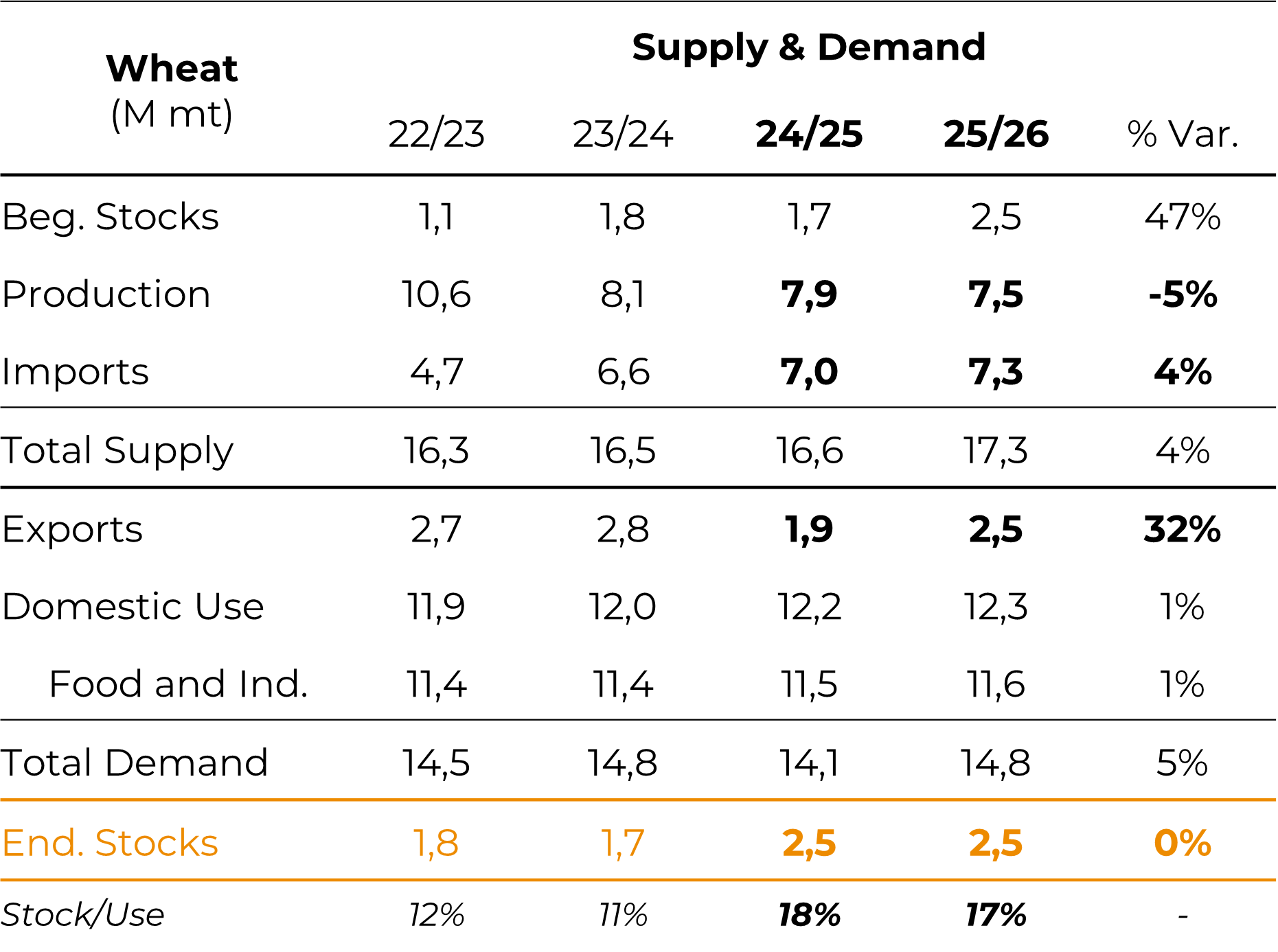

Wheat - Brazil - Supply and Demand

Source: USDA, Hedgepoint

USA

USA

- Production: estimated production of 52.4 Mt; area declining, but productivity recovering.

- Exports: already at a good pace (~13.6 Mt reported), but competition from the EU and Russia limits volume and price space.

Implication: The US remains an important player, but external pressure reduces the potential for price increases.

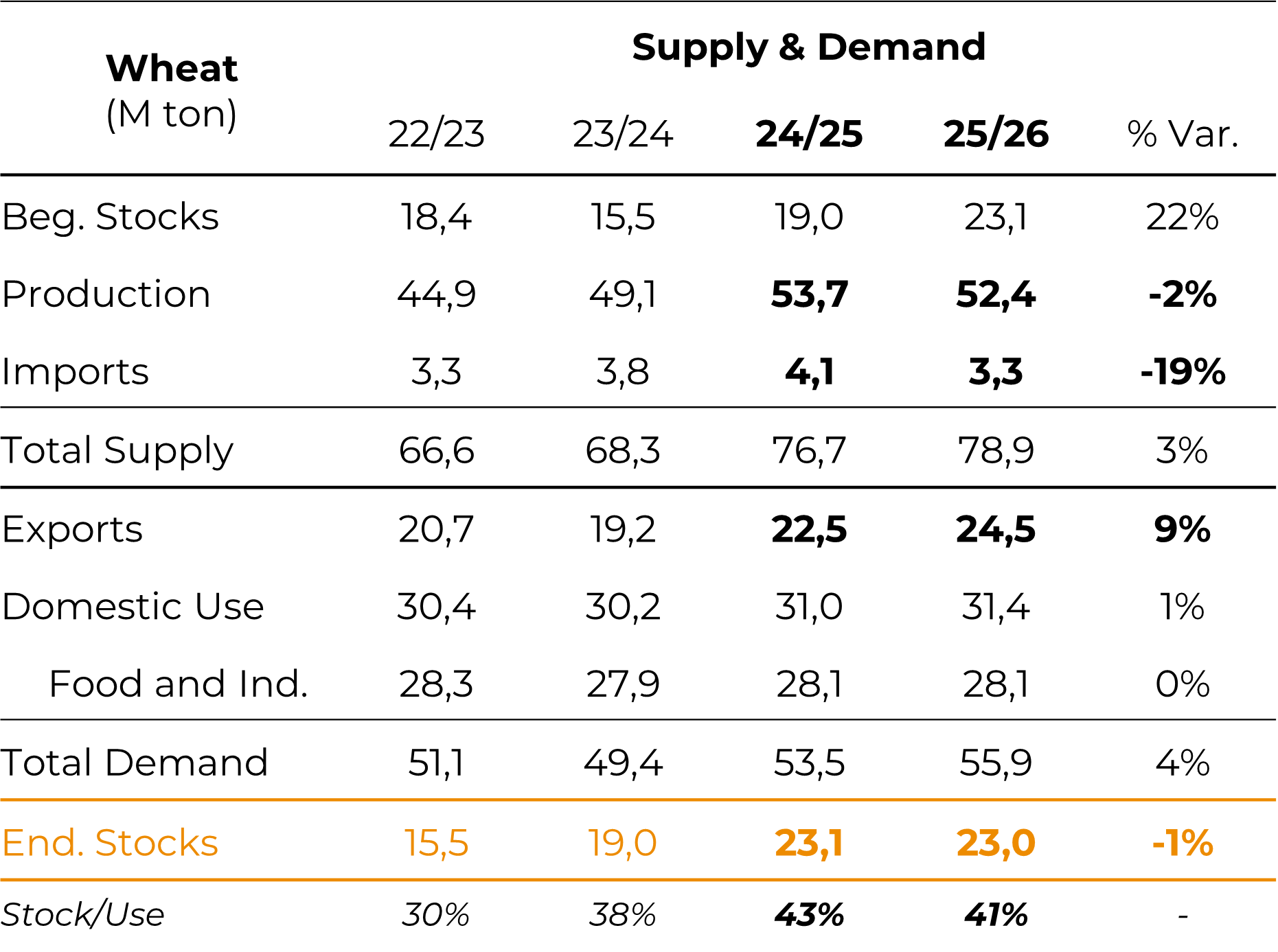

Wheat - USA - Supply and Demand

Source: USDA, Hedgepoint

European Union

European Union

- Robust harvest: estimated production of ~140 Mt — recovery vs. previous harvest (which had problems).

- Imports: expected to fall “by half” — less need for foreign wheat.

- Exports: increase in exportable supply, French wheat positioned as the most competitive in the market.

Impact: increased supply is a bearish factor for international prices (Matif + influence in Chicago).

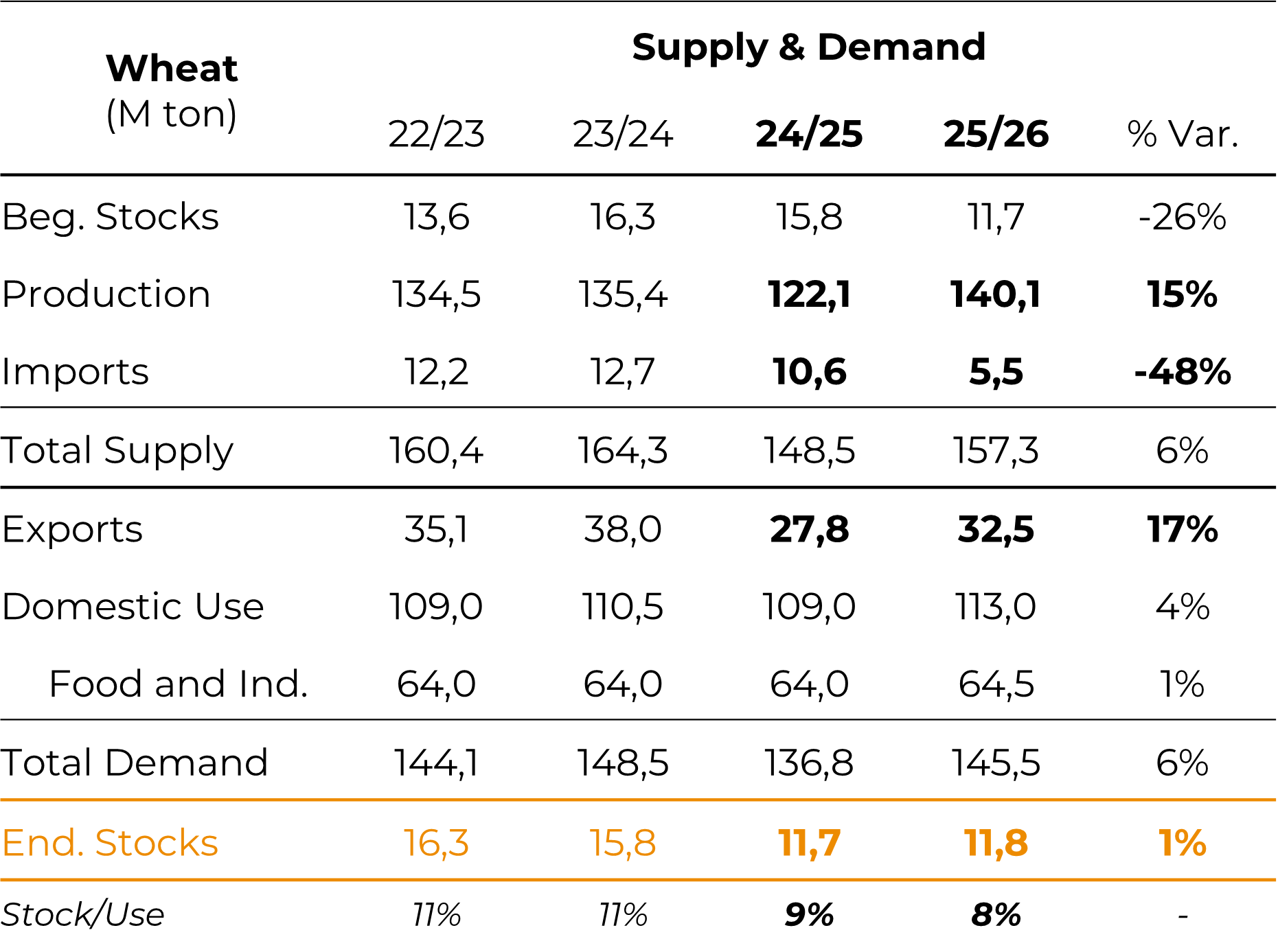

Wheat - European Union - Supply and Demand

Source: USDA, Hedgepoint

Argentina

Argentina

- Harvest and conditions: USDA estimates production at 19.5 Mt, local exchanges at up to 23 Mt; crops in good condition and harvest beginning (5% harvested, above average).

- Sales: temporary reduction in “retenciones” generated ~3 Mt sold in 3 days.

- Estimated exports: 13 Mt. Brazil will absorb most of it.

Implication: Argentina strengthens regional supply; exports should increase.

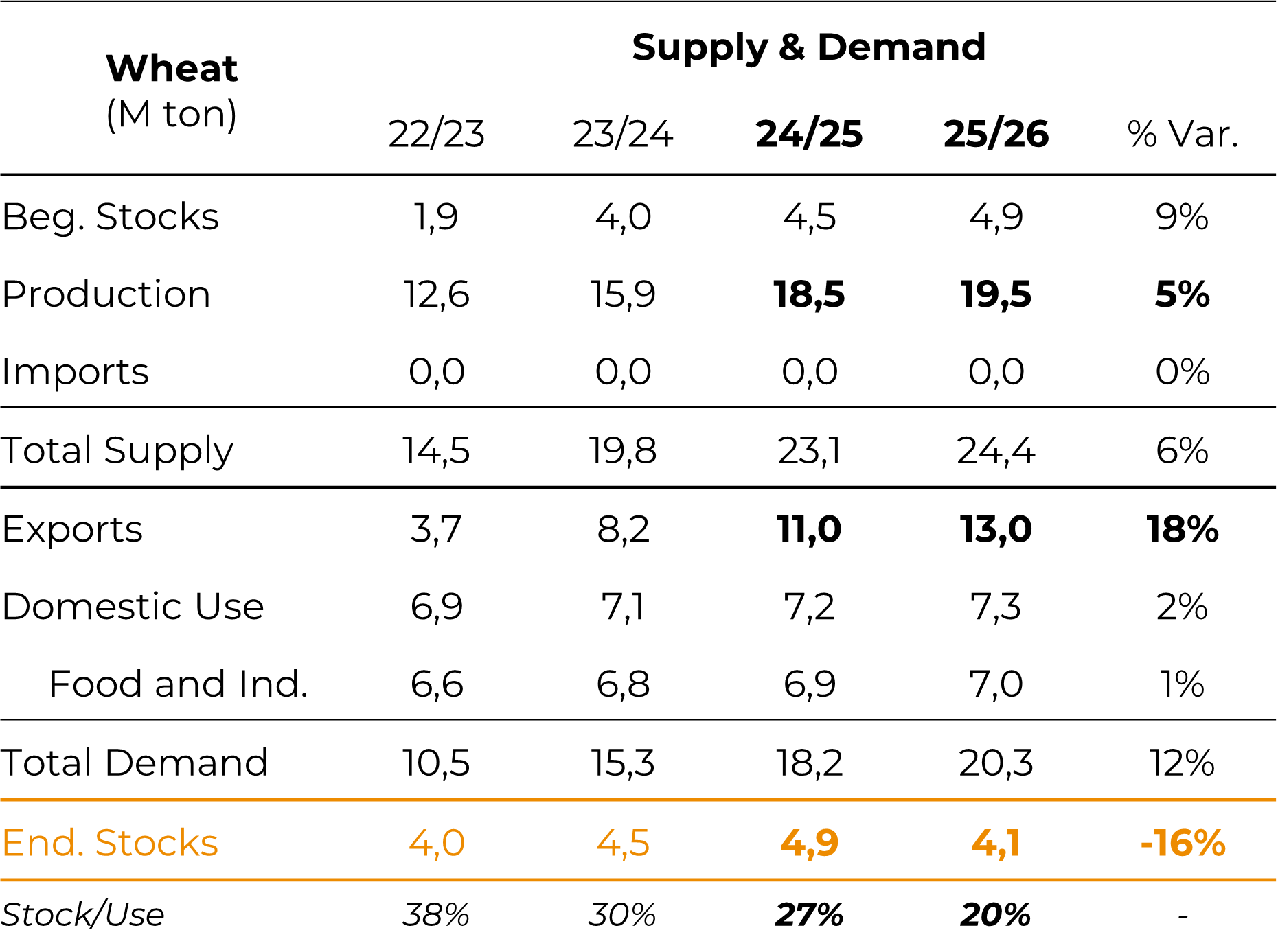

Wheat - Argentina - Supply and Demand

Source: USDA, Hedgepoint

Argentina - Sworn Declarations of Foreign Sales - Decree 682/2025

Source: Subsecretaría de Mercados Agroalimentarios e Inserción Internacional.

Ukraine

- Production conditions: production still significantly affected by the war — levels close to ~20 Mt (well below the pre-war 30–33 Mt).

- Logistics and mines: areas still contaminated by mines and compromised infrastructure; recovery is medium/long term.

Implication: Ukrainian supply remains restricted — geopolitical risk factor and volatility for wheat markets.

Wheat - Ukraine - Supply and Demand

Source: USDA, Hedgepoint

Russia

- Production and policies: production recovering (increase vs. previous year); export taxes reduced/practically eliminated, making Russian wheat more competitive.

Market impact: Russia is a driver of global downward pressure due to supply and competitive prices.

Wheat - Russia - Supply and Demand

Source: USDA, Hedgepoint

Wheat - Russia - Export Taxes (USD/ton)

Source: Argus

Bulls and Bears

Bullish factors

- The reopening of US-China talks may affect the grain market, especially soybeans.

- Possible negative adjustment in US corn in the next WASDE (significant reduction in US productivity/production) — price volatility.

- Climate risks associated with the return of La Niña, especially for Argentina and southern Brazil.

- Structured domestic demand in Brazil (corn ethanol) absorbs significant volume, supporting local prices.

Bearish factors

- Record harvest in the US (corn) and expanded production in the EU/Russia (wheat) — ample global supply.

- Increased export competition: US + Argentina + Brazil in corn; US + EU + Russia + Argentina in wheat; prices with little room for appreciation.

- Production recovery in the European Union (wheat) reducing demand for imports (direct impact on Ukrainian wheat).

- Market awaiting official data (WASDE) — when data returns, there may be adjustments that keep prices under pressure if high supply is confirmed.

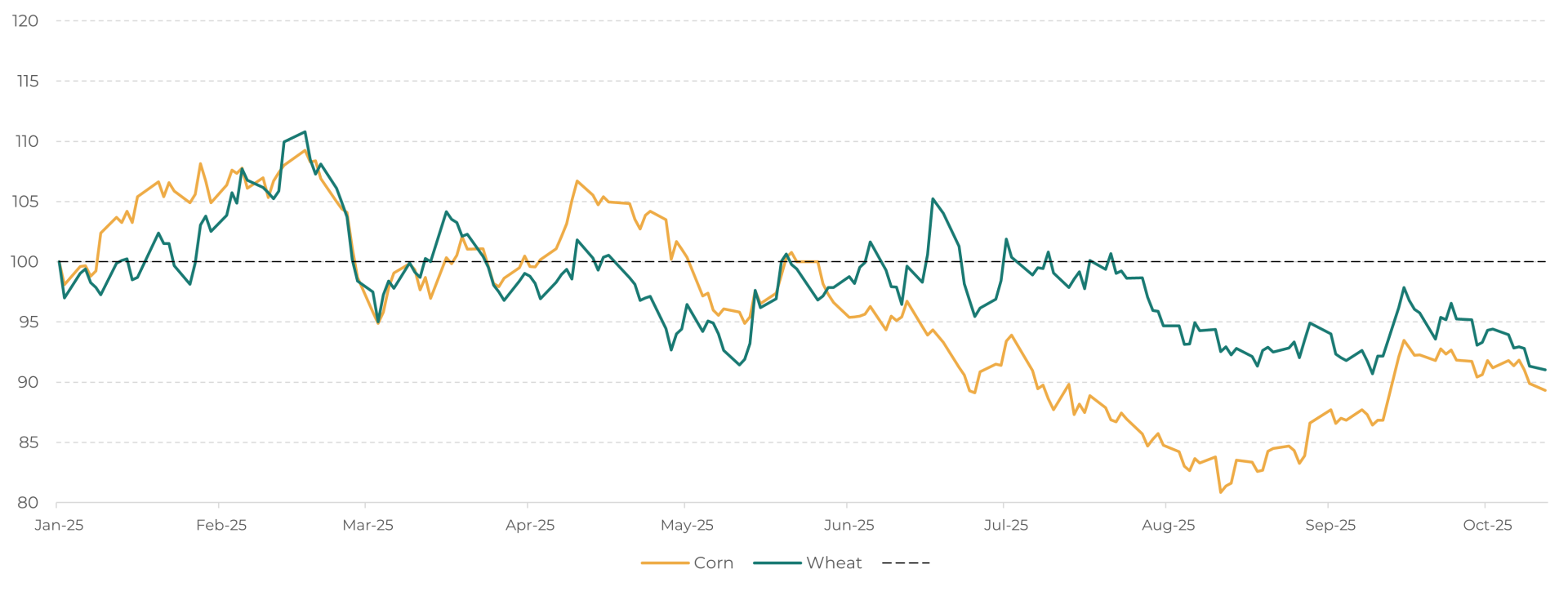

Wheat and Corn Price Index (Jan-25 = 100)

Source: CME, Hedgepoint

Final considerations

Final considerations

Link - October's Call

Written by Luiz F. Roque

Luiz.Roque@hedgepointglobal.com

Reviewed by Thais Italiani

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.