European Coffee Stocks fall in February

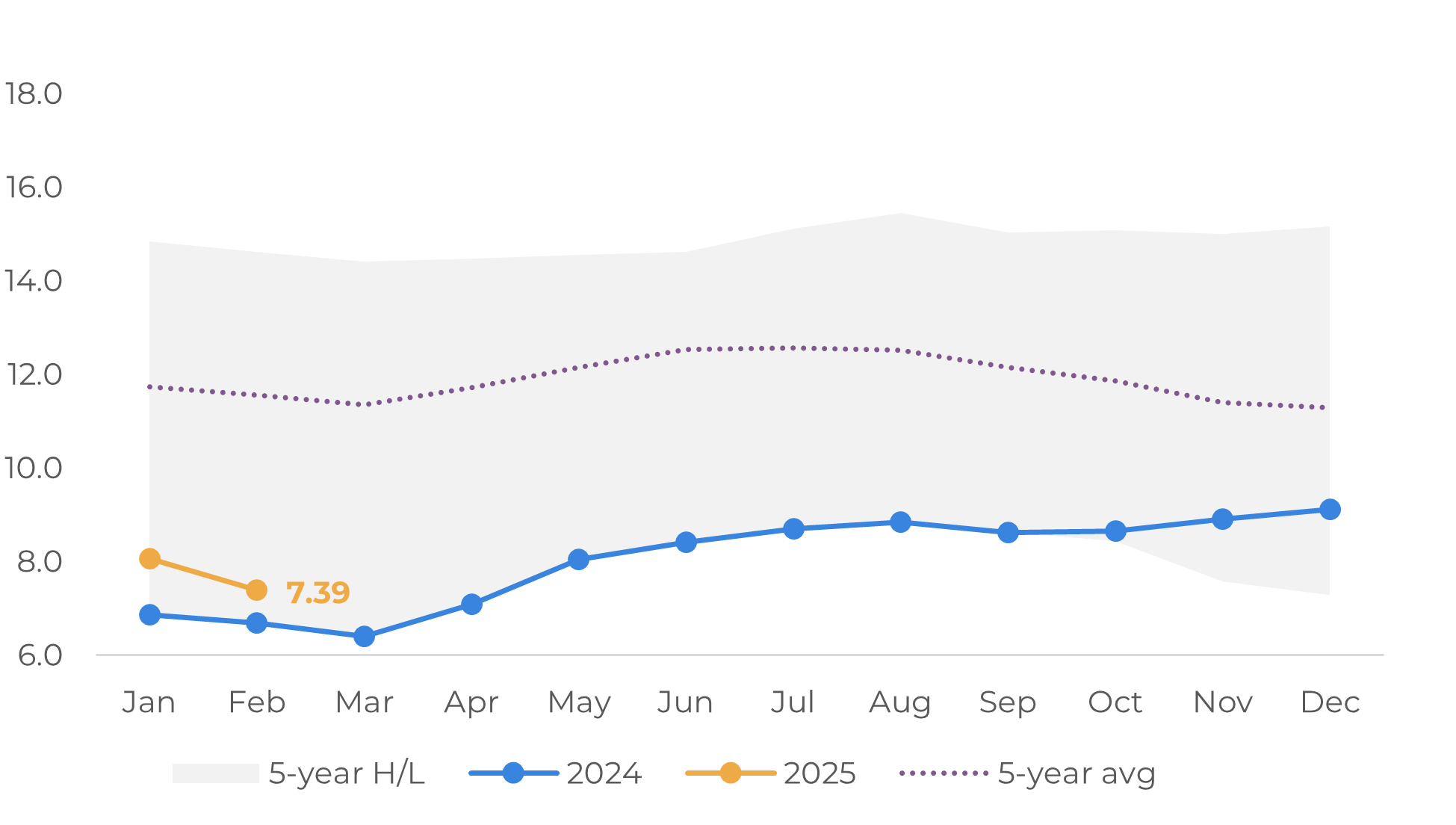

- The latest data by ECF (European Coffee Federation) shows a decrease in coffee stocks in the EU last month. While the figures are above 2024, they are still way below average levels and one of the lowest volumes in decades.

- The drop was likely a reflection of a slower pace of imports. Net import figures showed a sharp decrease in January and February, below 2024 and average levels. This movement could also lead to a reduction in consumption in the bloc.

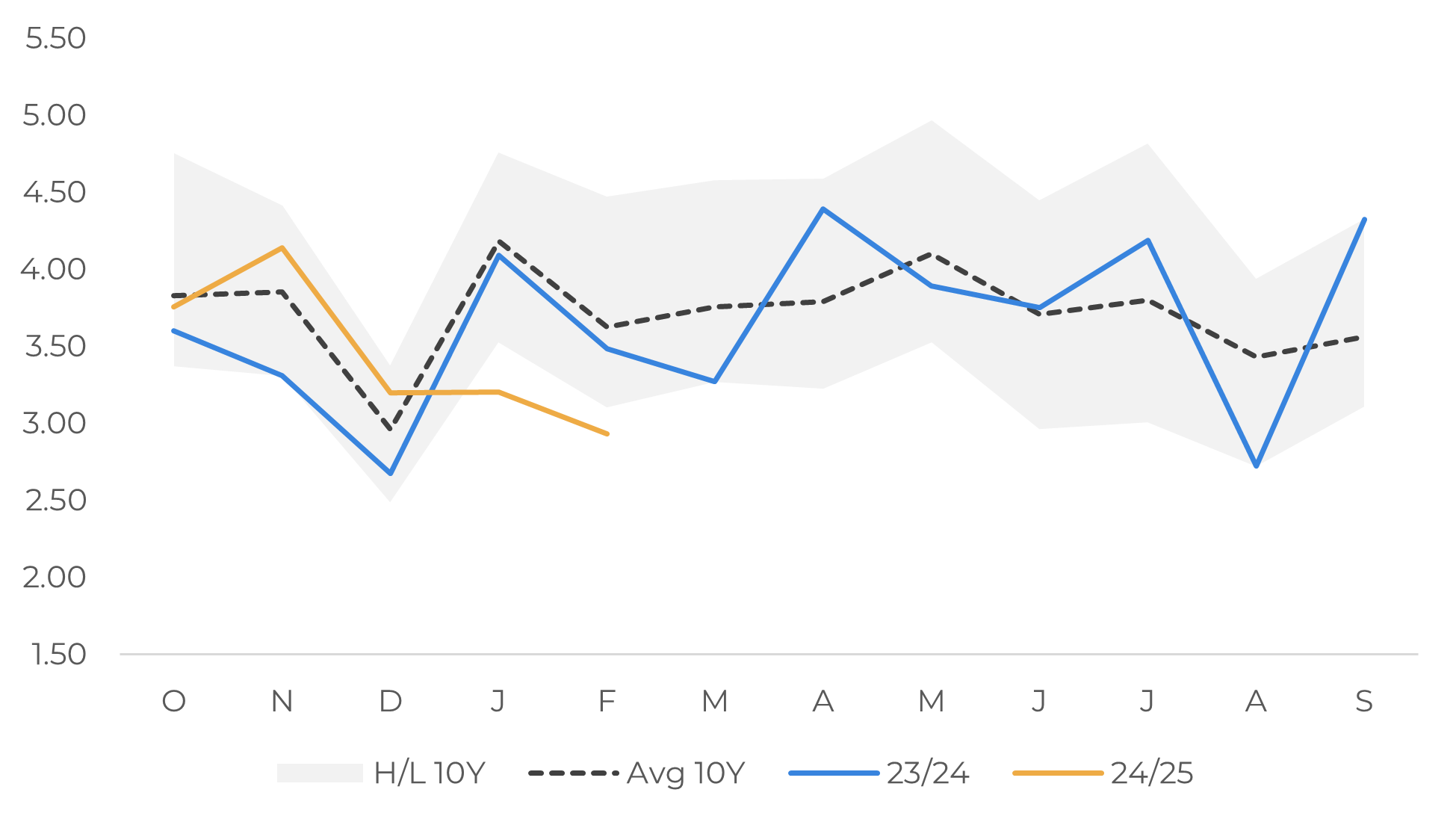

- Growing signs of demand weakness combined with the expectation of further increases in consumer prices around the globe pressured down future prices, despite worries about a smaller Arabica crop in 25/26 in Brazil and tight Robusta supply in Asia.

- Adding to the bearish trend, the forecast shows a more positive scenario in Brazil, with rains expected in major producing areas.

European Coffee Stocks fall in February

EU: ECF Stocks (M bags)

Source: ECF

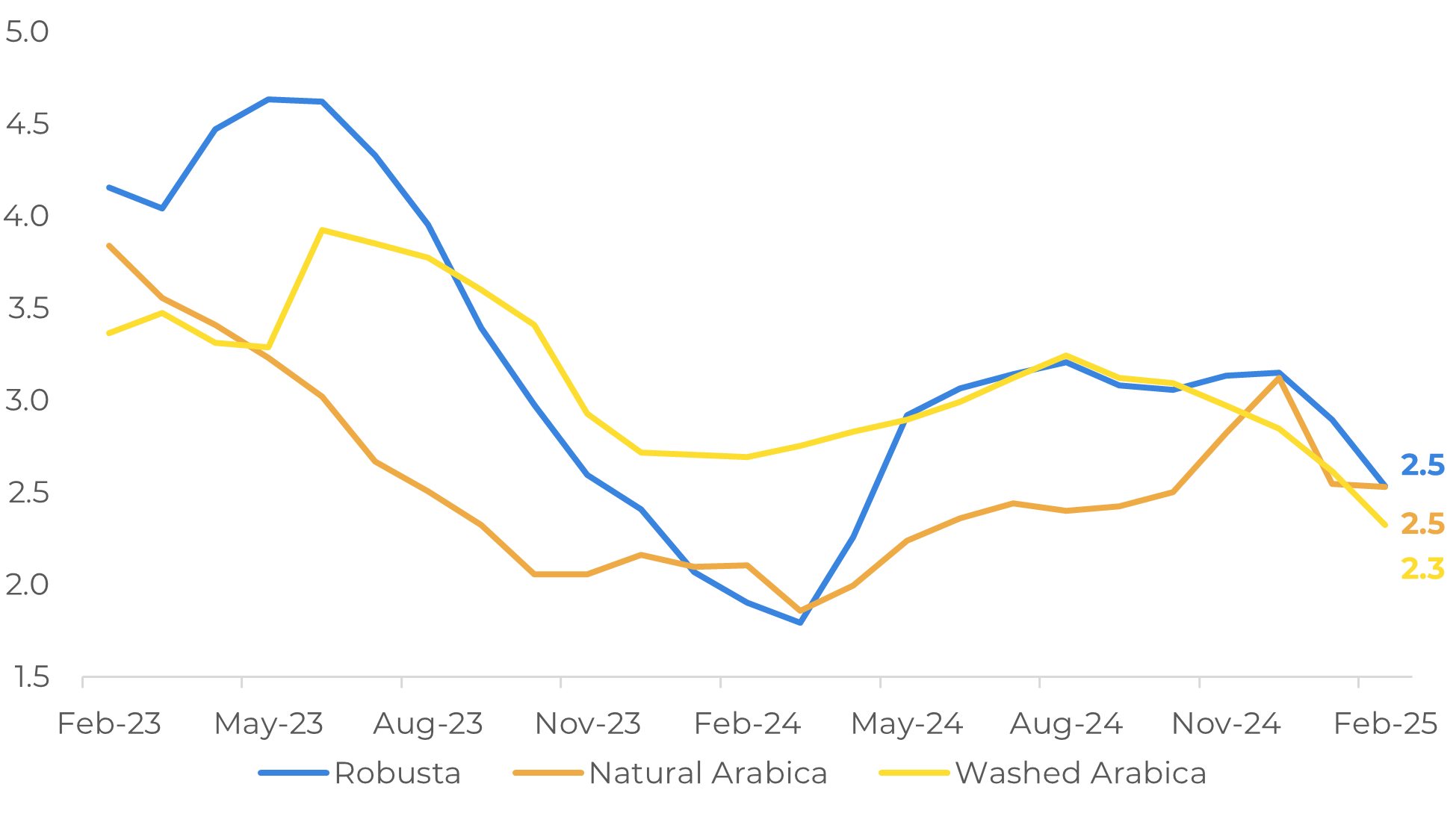

EU: ECF Stocks by Type (M bags)

Source: ECF

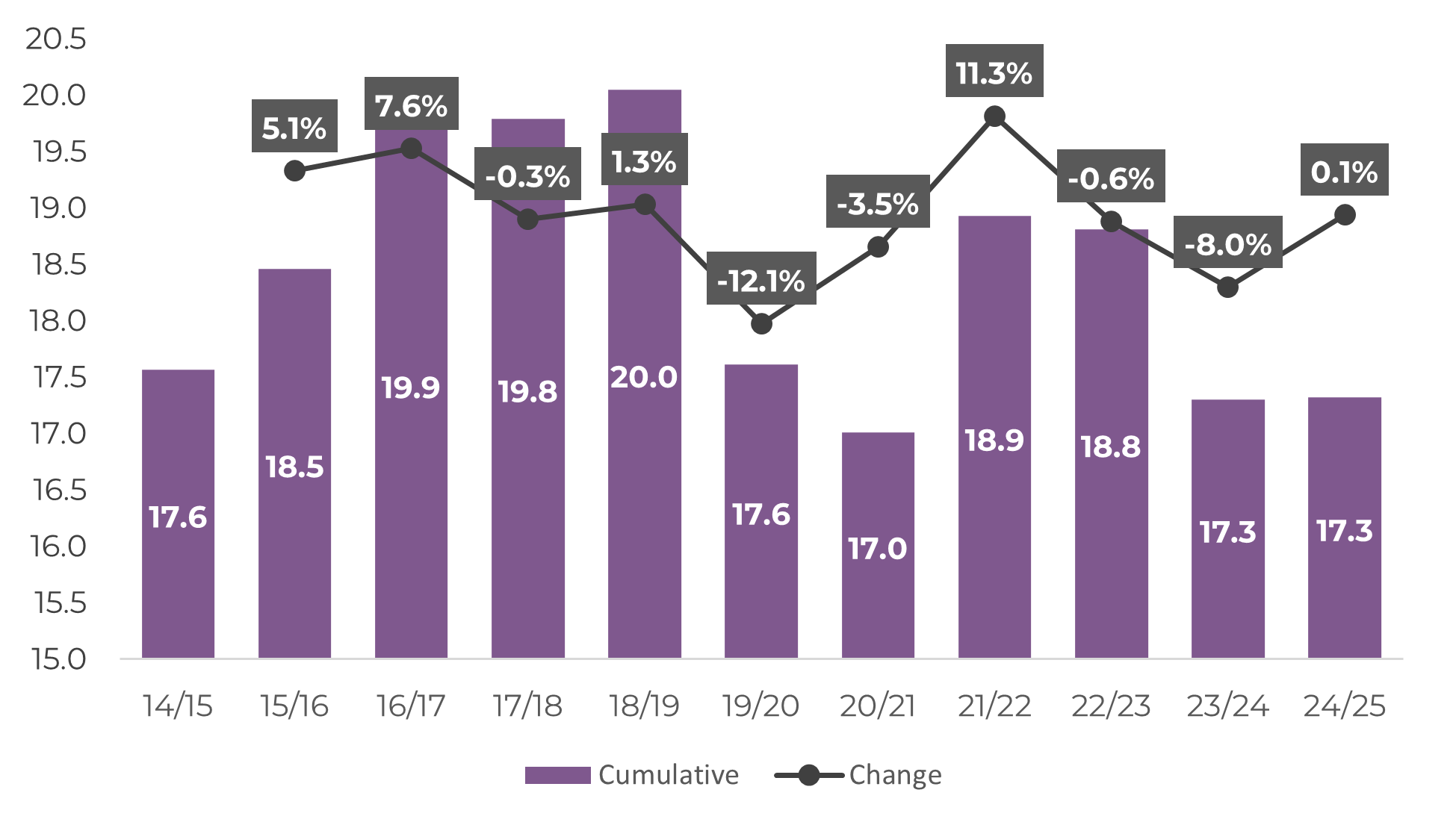

The latest data on European green coffee net imports (imports - re-exports) adds to some of the current concerns about demand. Firstly, looking at the cumulative figures for the 24/25 season (Oct/24-Feb/25), net imports are at 17.3 M bags, similar to 23/24, but still 6.6% below the average for the period (18.5 M bags). What is really concerning, however, is the pace of imports in 2025: while they were in line with seasonality from October to December/24, there has been a sharp decline since January, with imports at their lowest level in 10 years.

In addition, news of a further increase in consumer coffee prices hit the market this week. Issues regarding contract negotiations between roasters and grocery stores have recently arisen in Europe, with the former pushing for price increases and the latter postponing new contracts, even leading to a lack of supply of some brands in some areas of the region. Although most of these disputes came to an end in March, the result was an increase in retail prices. Labels such as Lavazza, Nestle and JDE are also in open discussions with retailers about passing on rising costs in the coming months, which could lead to a further increase in consumer prices. As mentioned in previous analysis (link) EU consumers have already seen an increase in recent months and could see even more expensive coffee in 2025. This also reinforces the view that we could see a decline in demand (and imports) in the coming months.

EU: Cumulative Green Coffee Net Import x Change (M bags)

Source: Eropean Comission, Hedgepoint

EU: Green Coffee Net Import (M bags)

Source: Eropean Comission, Hedgepoint

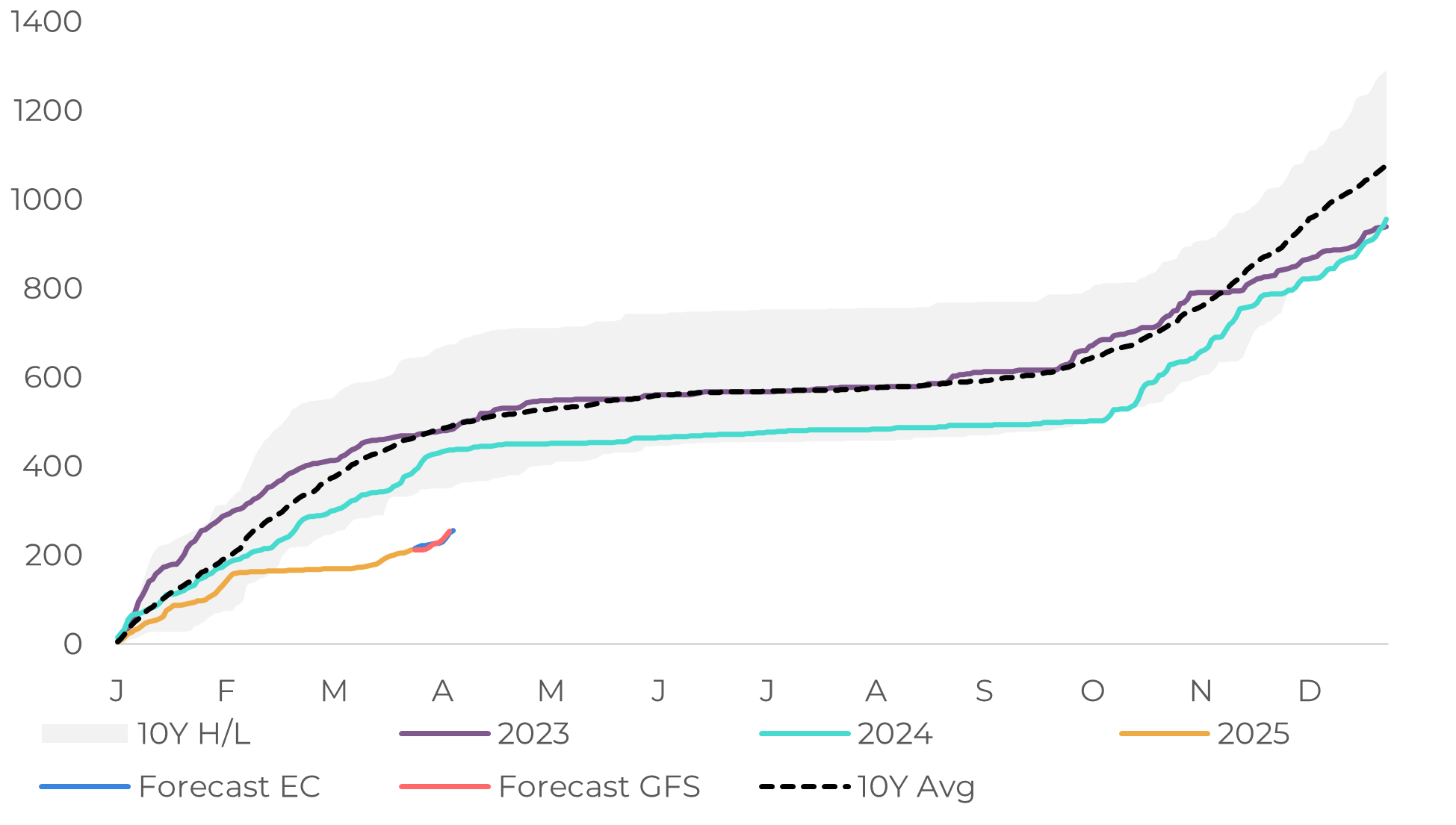

Brazil: Minas Gerais Cumulative Precipitation (mm)

Source: Refinitiv, Hedgepoint

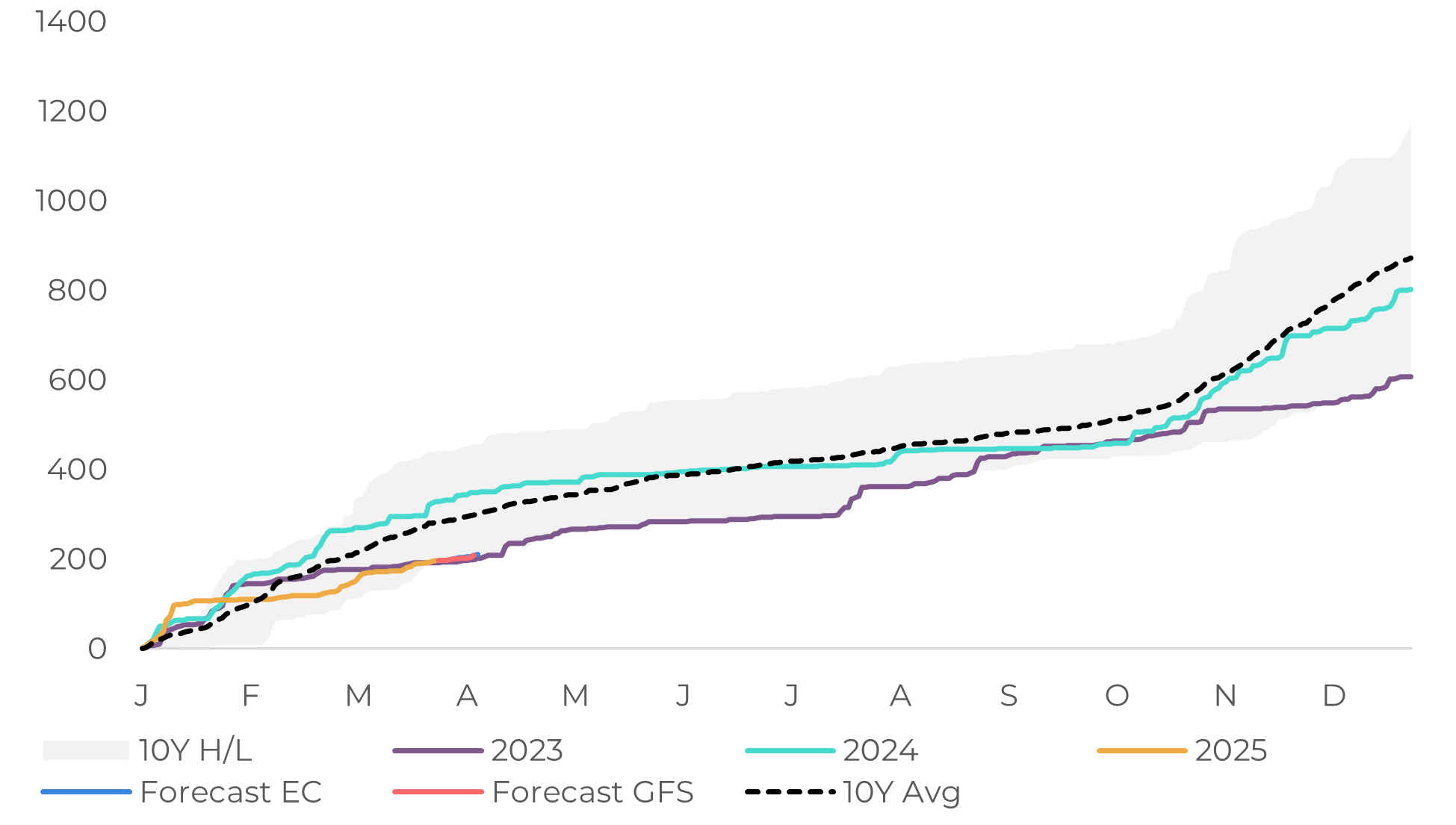

Brazil: Espírito Santo Cumulative Precipitation (mm

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.