Prices rise with lower Arabica crop in Brazil and news on demand

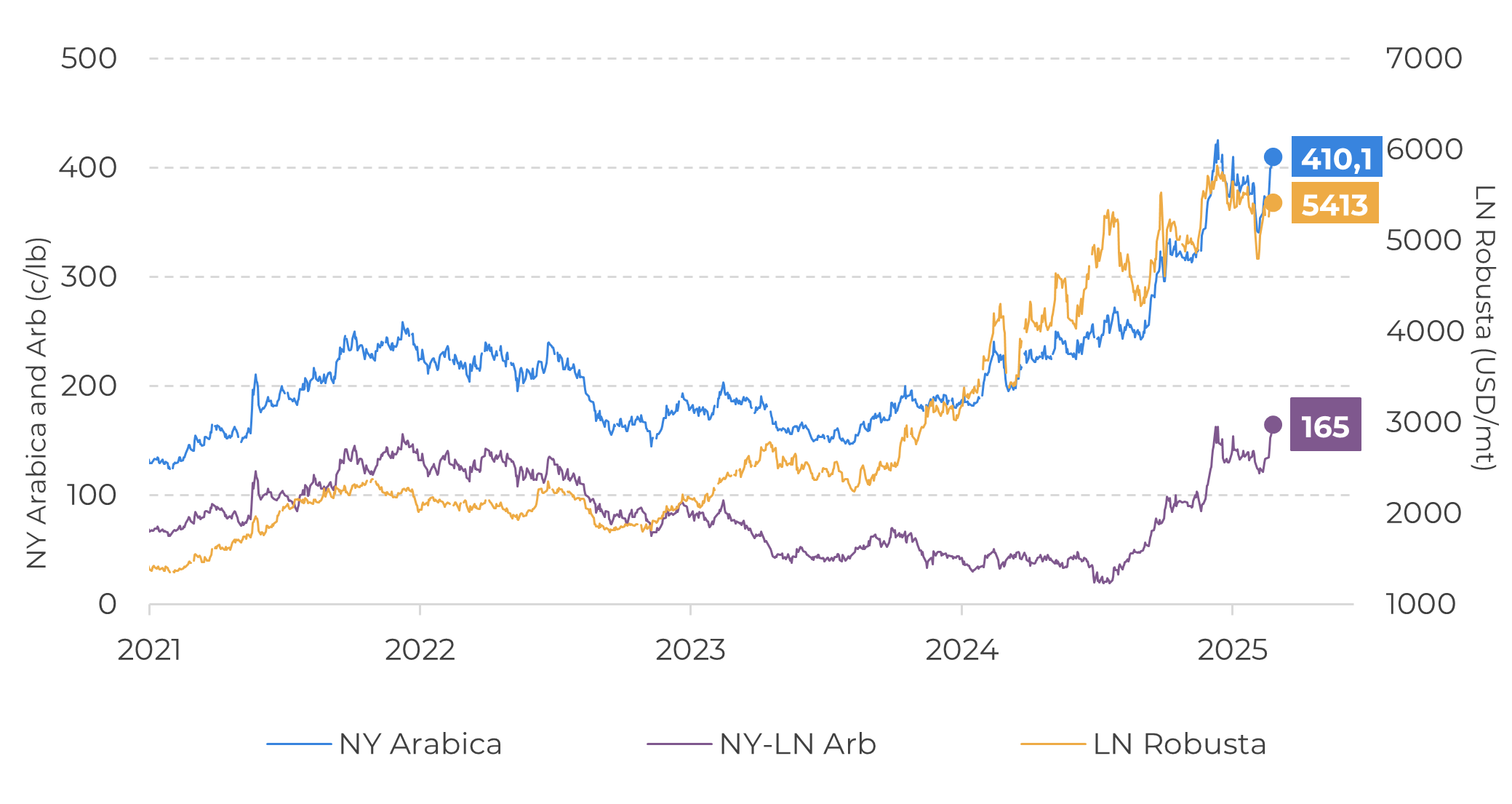

- Coffee prices fell in April after the “Liberation Day” and the ongoing fears of a trade war. However, recently, both Arabica and Robusta futures prices have surged, driven by perspectives of a smaller Arabica cycle in Brazil for the 25/26 season. Arabica’s July/25 contract hit a 7-week high this Monday (28), at 410.05 c/lb, while Robusta’s July traded above 5.400 USD/mt.

- The market indicated not only the potential challenges related to Arabica supply but also responded to some optimistic news regarding demand, as one of the largest industries in the sector announced on Thursday (24) that, the price increases implemented in coffee categories had “limited customer disruption”. The company also announced an investment in a new coffee facility in Vietnam on the same day, highlighting the resilience in the sector.

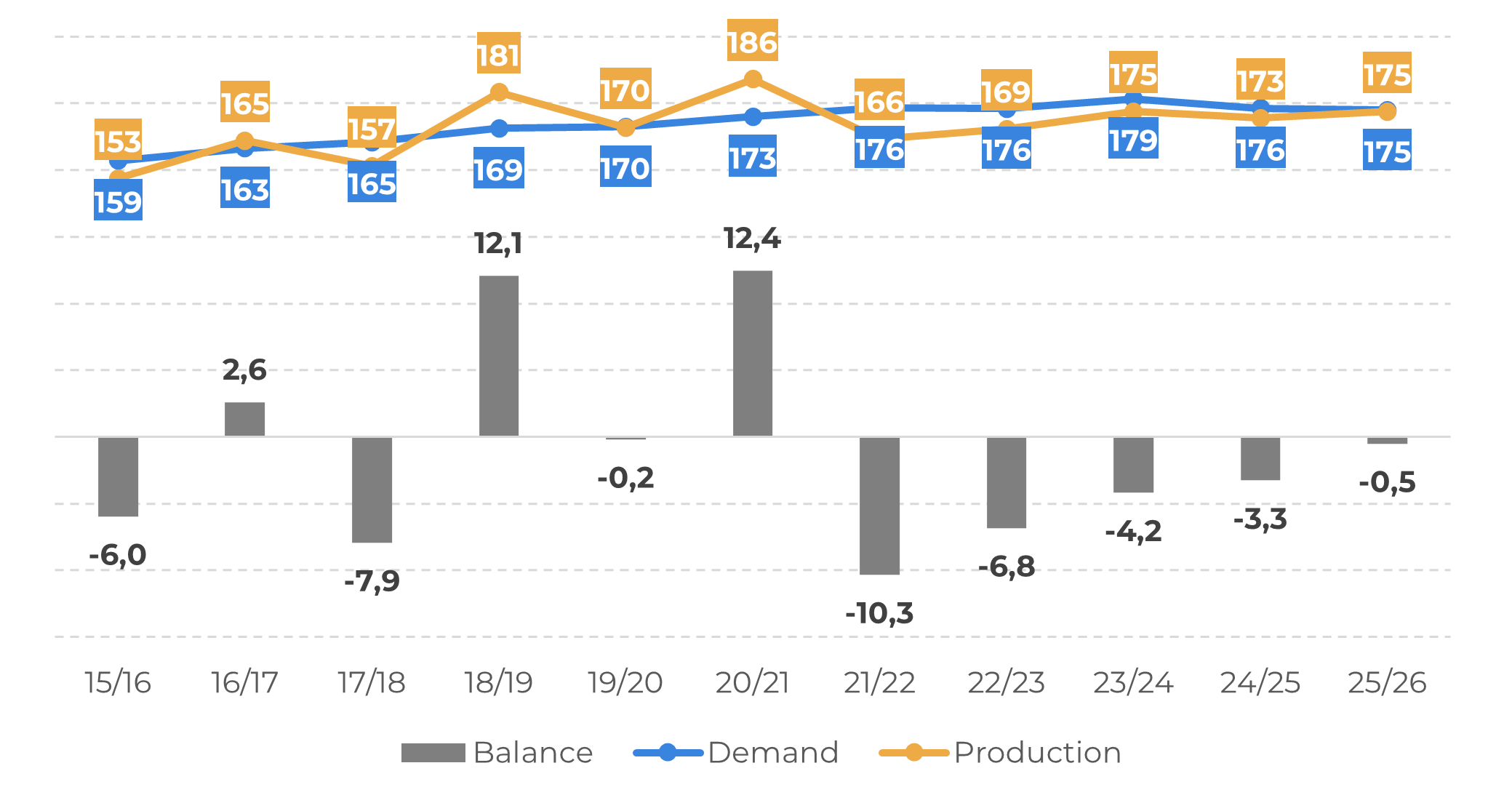

- Our model still indicates a drop in demand in 24/25 cycle, due to higher prices (Arabica and Robusta), and a marginal decrease in 25/26. However, even with the expected drop, global balance points to a deficit, indicating that the tight supply could continue.

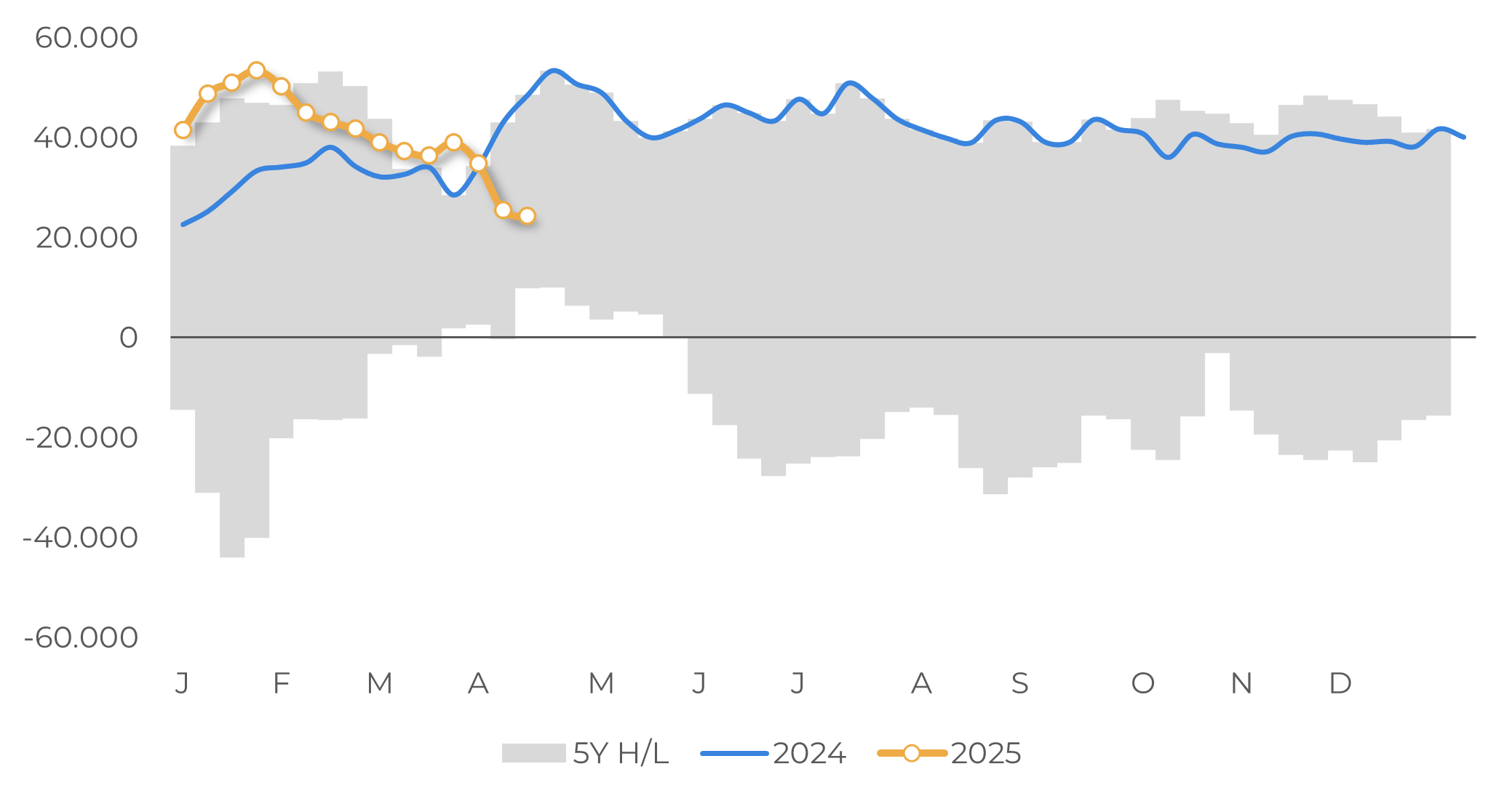

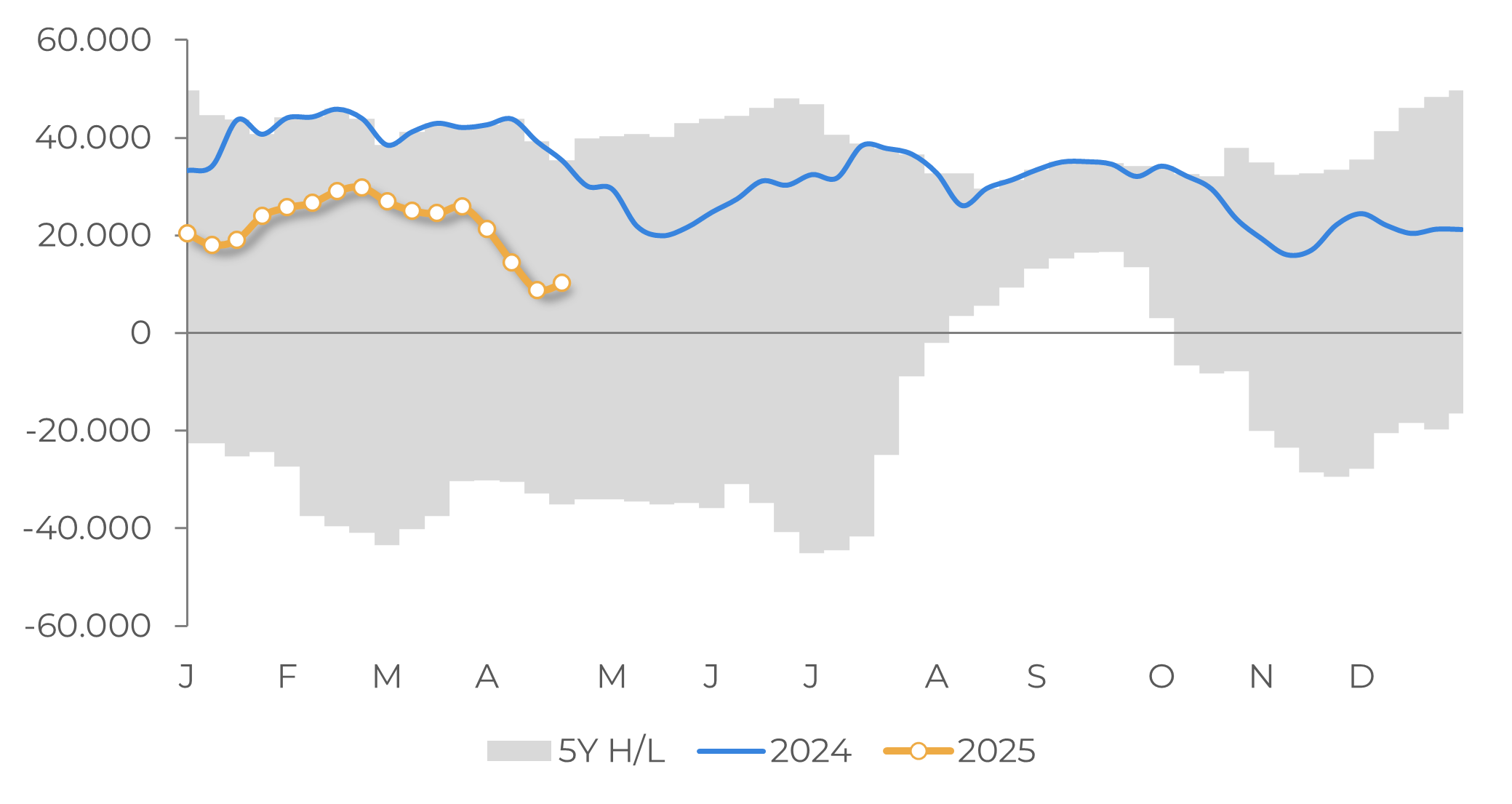

- Last Friday CFTC and ICE funds reports also showed an interesting turn, with speculative funds positions raising long positions.

Prices rise with lower Arabica crop in Brazil and news on demand

LN Robusta (USD/mt) NY Arabica and Arbitrage (c/lb)

Source: Refinitiv

Global Coffee Balance (M bags)

Source: Hedgepoint

The drop in Robusta demand in 24/25 – especially in origins – and the expected Arabica drop in 25/26 indicates a decrease in global demand in 24/25 and a marginal drop in 25/26. On the other hand, with limited production in both cycles, this would still mean a tight supply in the coming months, which could give support to prices throughout the seasons, as we are already seeing in the current market.

On another note, an interesting development is occurring with the speculative fund positions of Arabica and Robusta. Since early 2025, both ICE and CFTC funds have reduced their long positions, likely in response to rising hedge costs and expectations of a decline in coffee demand. However, in the most recent report, they have once again increased their long positions. While it's crucial to monitor future movements, this may suggest that speculative funds are detecting a shift in the market given the expectation of tight supplies ahead, potentially indicating a support for prices at the current levels.

Arabica: CFTC Speculative Fund Positions (lots)

Source: CFTC

Robusta: ICE Speculative Fund Positions (lots)

Source: ICE

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com