Supply Prospects Push Prices Lower

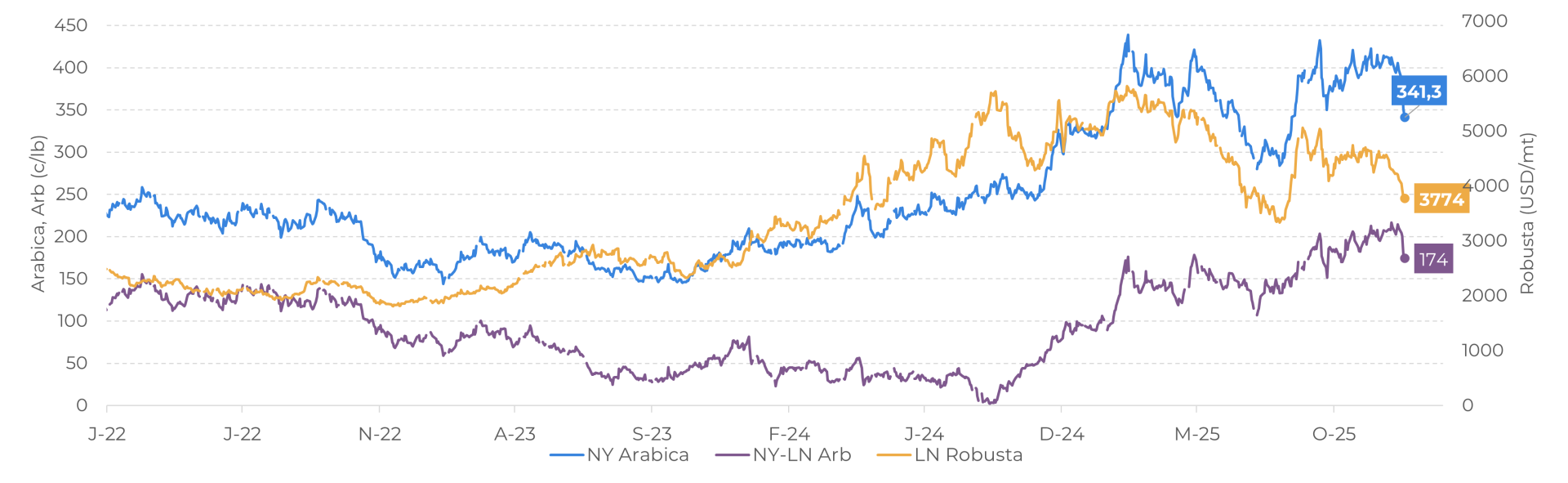

- Futures prices for Arabica and Robusta coffees have fallen in recent days, reflecting prospects for improved supply in the coming months, with the harvest of the 25/26 season in Vietnam and the development of the 26/27 crop in Brazil, as well as a slight recovery in ICE certified stocks.

- Harvest in Vietnam, which was delayed by heavy rains in recent months, began to pick up pace in December. Exports for the 25/26 season are also above the same period of 24/25.

- In Brazil, the weather remains favorable for the 26/27 season’s development, with expectations of a recovery in Arabica production in the next cycle, adding to the bearish outlook for prices.

- Exports and sales, however, remain at lower levels, restricting Brazilian supply in the short term. However, with higher stocks in the country and the end of tariffs on coffee, exports may still pick up pace in the coming months.

- This week also saw the approval of the postponement of the European Union Anti-Deforestation Regulation (EUDR) application.

Supply Prospects Push Prices Lower

LN-Robusta (USD/mt), NY-Arabica and Arbitrage (c/lb) (2nd contract)

Source: LSEG

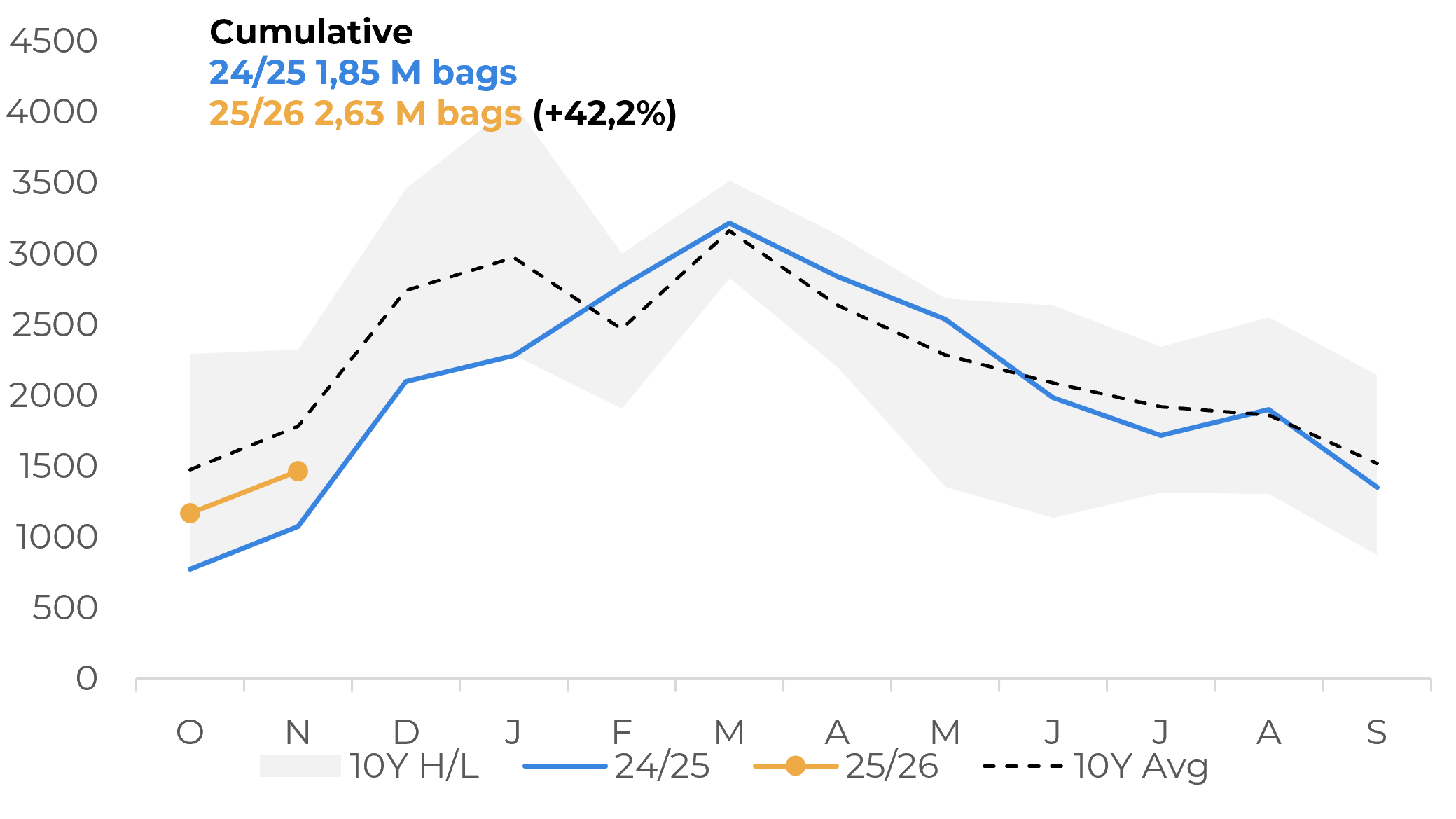

In Vietnam (the world's second-largest producer), the 25/26 harvest began to pick up pace in December after delays in recent months. Constant and heavy rains since October, caused by several typhoons and storms, prevented producers from harvesting coffee and delayed the drying of beans, in addition to causing logistical problems. However, with the reduction in rainfall this month and the normalization of work, more coffee has been reaching the market, with reports of more aggressive sales by Vietnamese traders in recent days.

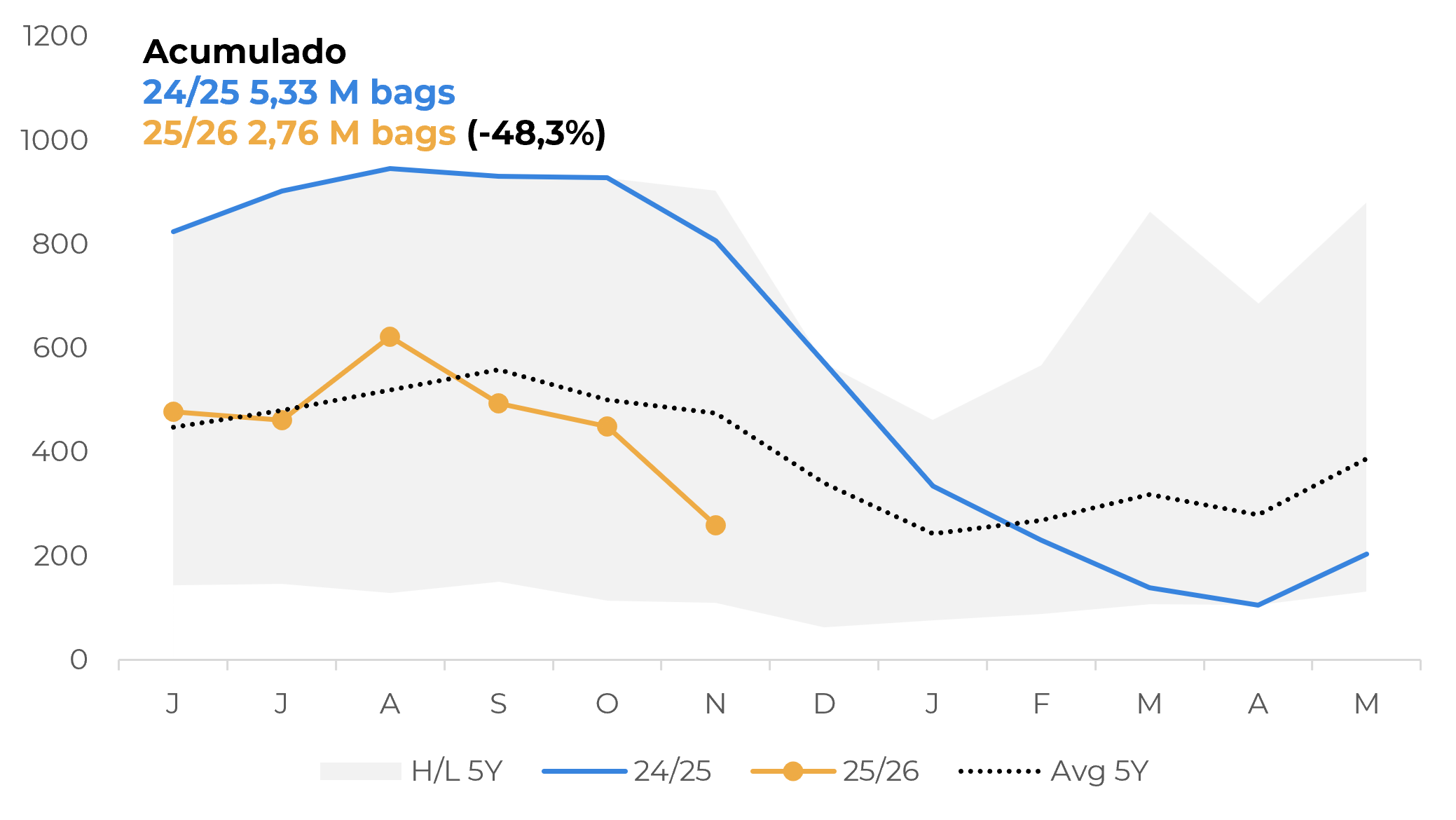

In addition, even with the delay in field work in recent months, Vietnam's coffee exports are beginning to show signs of recovery. In the first two months of the 25/26 season (Oct. and Nov.), the Asian country has already exported 2.6 million bags, an increase of 42.2% over the same period in 24/25 crop. With higher production expected this year and the harvest finally gaining momentum, shipments from the country are expected to remain at higher levels, increasing supply in the coming months.

Vietnam: Total Coffee Exports (‘000 bags)

Source: LSEG, ICO

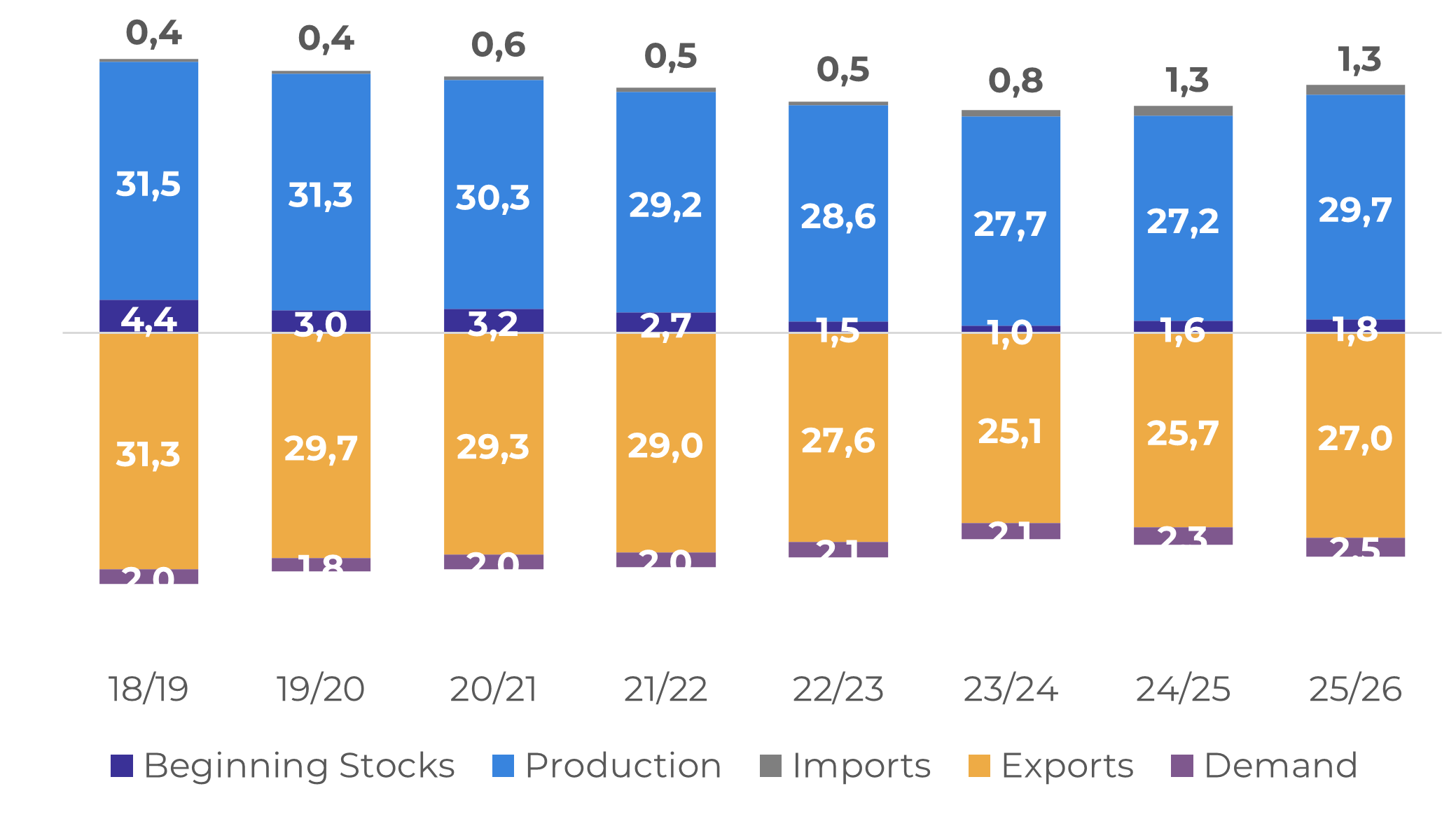

Vietnam: Supply and Demand (M bags)

Source: Hedgepoint

It is worth remembering that other origins, such as Uganda, Ethiopia, Colombia, and Central American countries, are also in their 25/26 harvest period, which tends to contribute to global coffee exports and trade flows in the coming months.

However, the development of Brazil's 26/27 crop, as well as the country's exports, remains one of the market's main points of attention. So far, rainfall has been beneficial for the filling of Arabica and Conilon beans in the country, with expectations of a recovery in the former variety in the next cycle, which could lead to production of between 71 and 74.4 million bags (see our complete figures) and help in the recovery of global stocks.

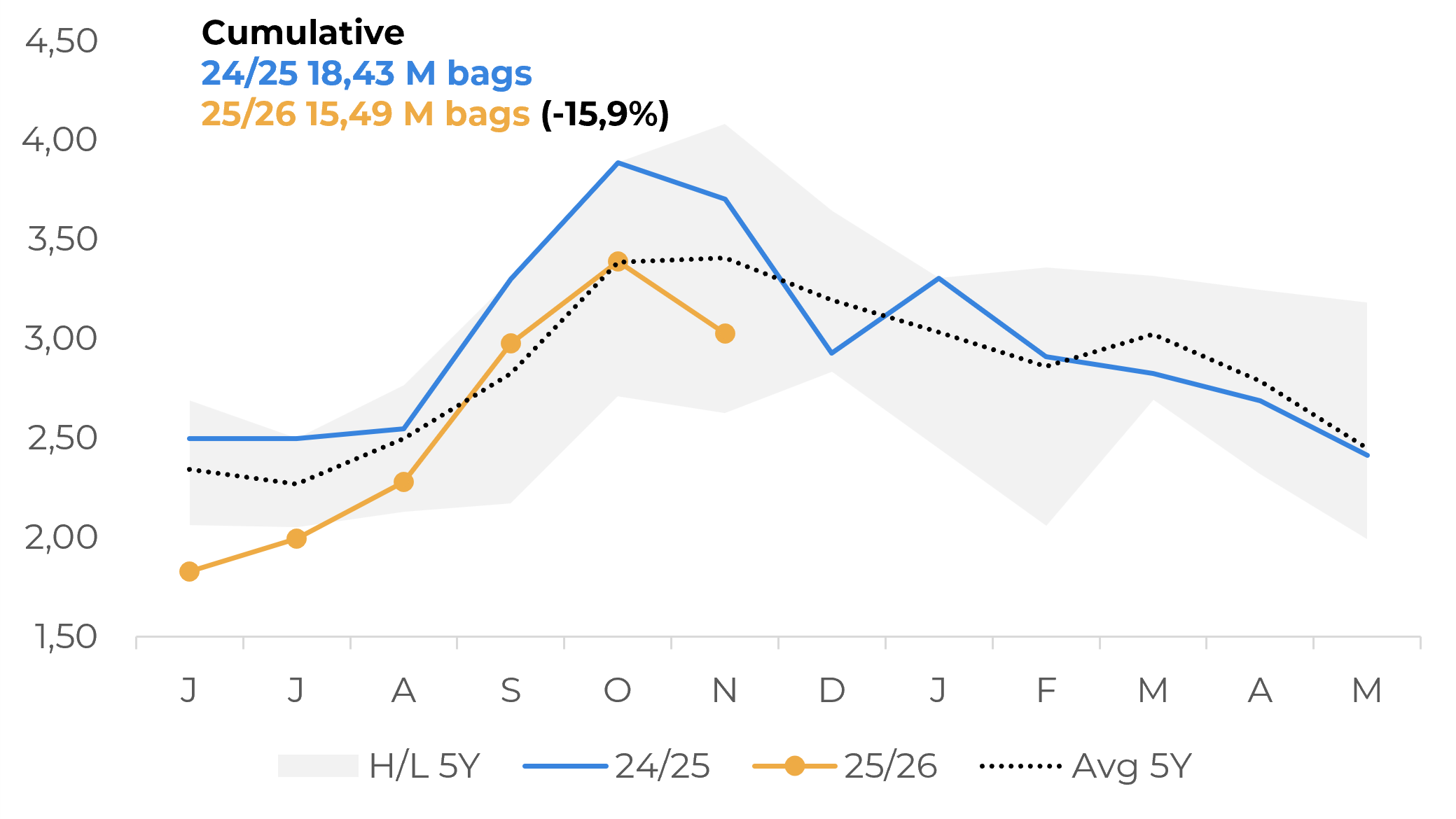

On the other hand, exports for the 25/26 cycle remained slower. Data from Cecafé point to a drop in shipments in November, with only 3.5 million bags of coffee in total, down 13.6% from October and 26.7% from the same period in 2024. Of this amount, Arabica coffee exports totaled 3.03 million bags, 18.3% lower than last year, while Conilon shipments reached 259,300 bags, down 67.9% in the same comparison.

The Council noted that weaker performance was driven by two main factors: U.S. tariffs on Brazilian beans and delays in port infrastructure, which created shipping bottlenecks. Cecafé estimates that in October, more than 2,000 containers, equivalent to 681,590 bags of coffee, failed to leave port.

On the other hand, with tariffs lifted, exports are expected to increase from December. Still, duties on soluble coffee – which makes up around 10% of shipments to the U.S – along with ongoing logistical bottlenecks, could continue to pose challenges.

Brazil: Green Arabica Exports (M bags)

Source: Cecafé

Brazil: Green Conilon Exports (000 bags)

Source: Cecafé

It’s worth noting that weaker export figures may also reflect slower domestic sales in Brazil. Safras & Mercado reports that by November, coffee sales had reached 69% of the 25/26 harvest – below last year’s level of 79% and the five‑year average of 74%. This slowdown was seen in both Arabica and Conilon varieties. Overall, trading activity is expected to remain subdued through year‑end, particularly after recent price declines. Typically, producers increase sales volumes as the harvest nears to cover production costs.

Even so, although the presence of Brazilian producers in the market may remain low at the end of 2025 and beginning of 2026, pressure from a larger harvest in 26/27 assuming favorable Weather – may maintain the current downward trend in prices. Expectations of more comfortable supply in 2026 may also prompt speculative funds to liquidate part of their long positions, adding further pressure.

Beyond origins, regulatory developments in Europe are also weighing on sentiment. Last week, the European Parliament approved another postponement of the EU Anti Deforestation Regulation (EUDR). The text still requires approval by the Council and publication in the Official Journal of the EU before year end 2025. This delay strengthens bearish arguments, as European buyers now have additional time to secure coffee purchases.

In Summary

Weekly Report — Coffee

laleska.moda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.