Jul 5

/

Laleska Moda

Coffee Weekly Report - 2024 07 05

Back to main blog page

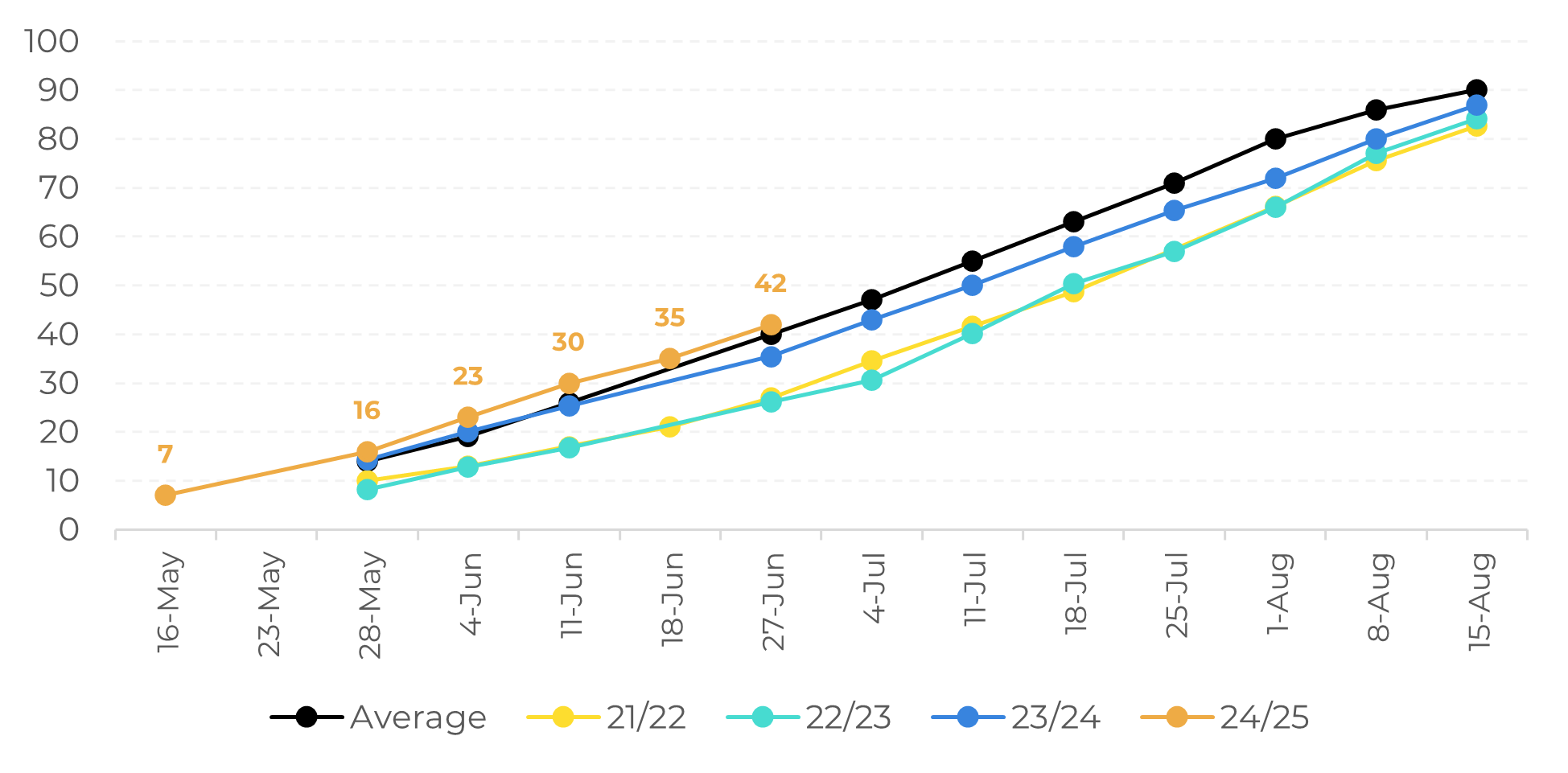

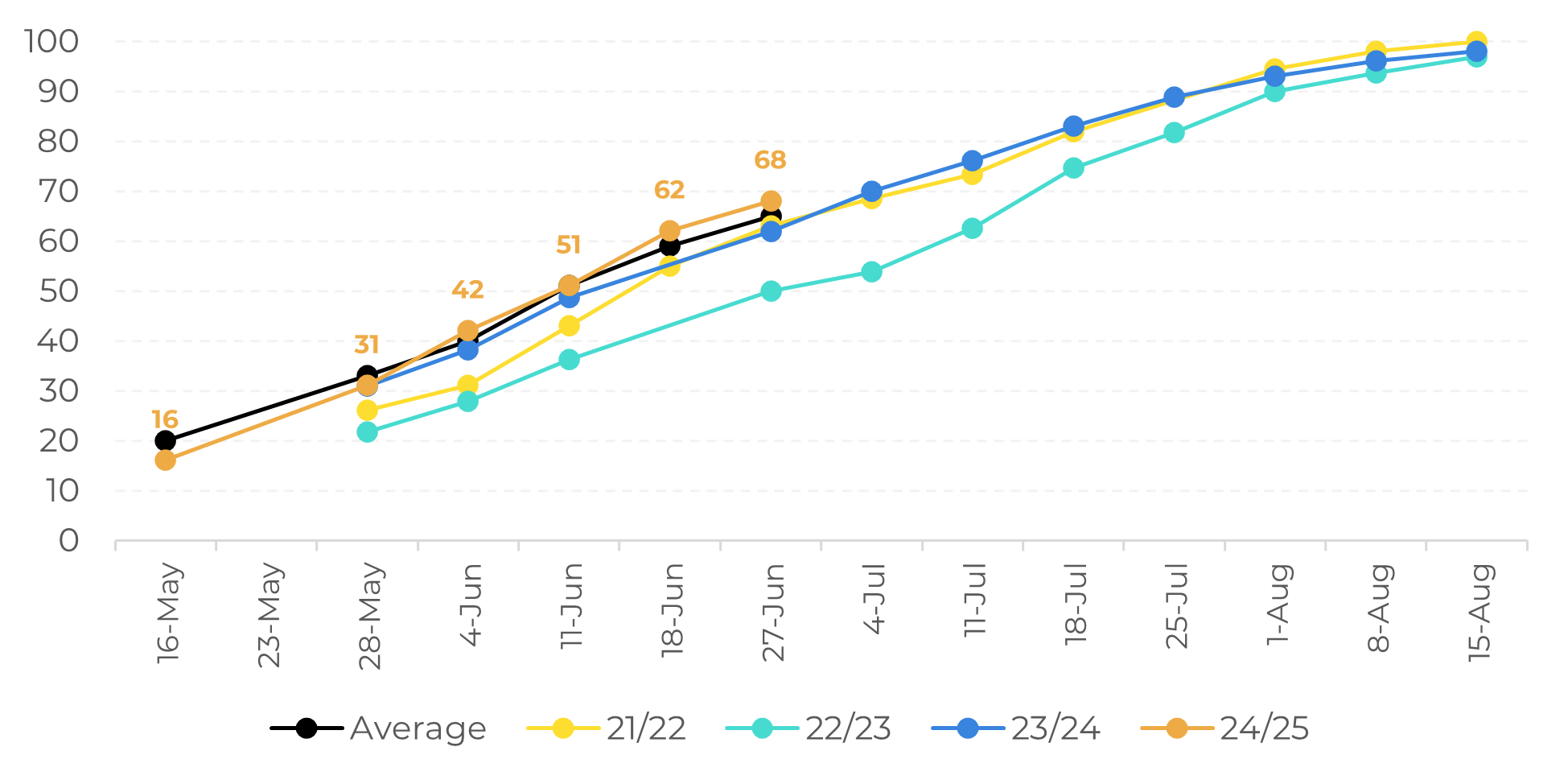

- The Brazilian 24/25 coffee harvest has already reached 58%, ahead of the five-year average for the first week of July.

- As of last week, arabica’s harvest had already reached 50% of the total, while robusta crop progress was estimated at 76%. The pace of both varieties is already above last year’s levels for this period and are higher than the five-year average.

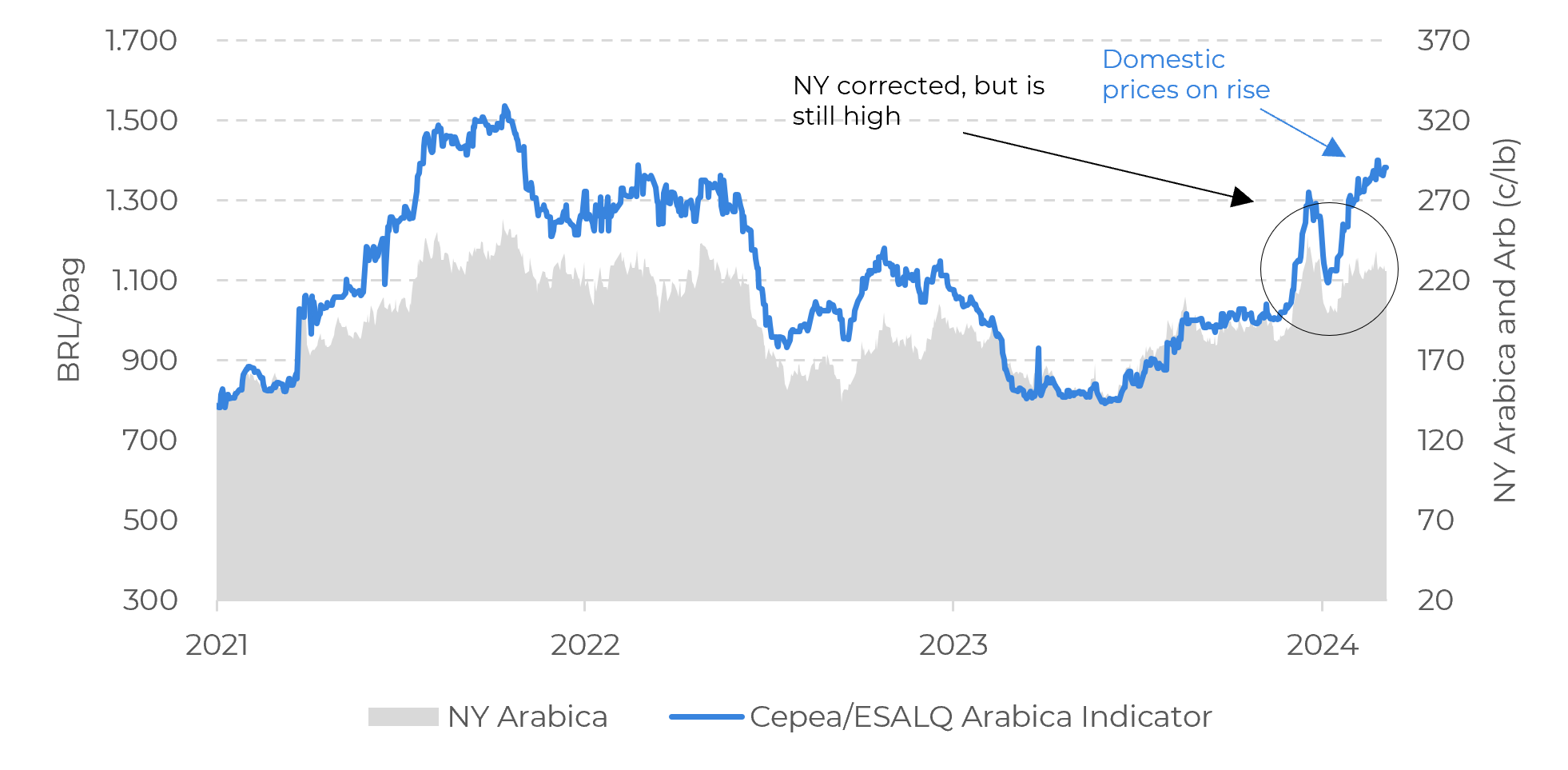

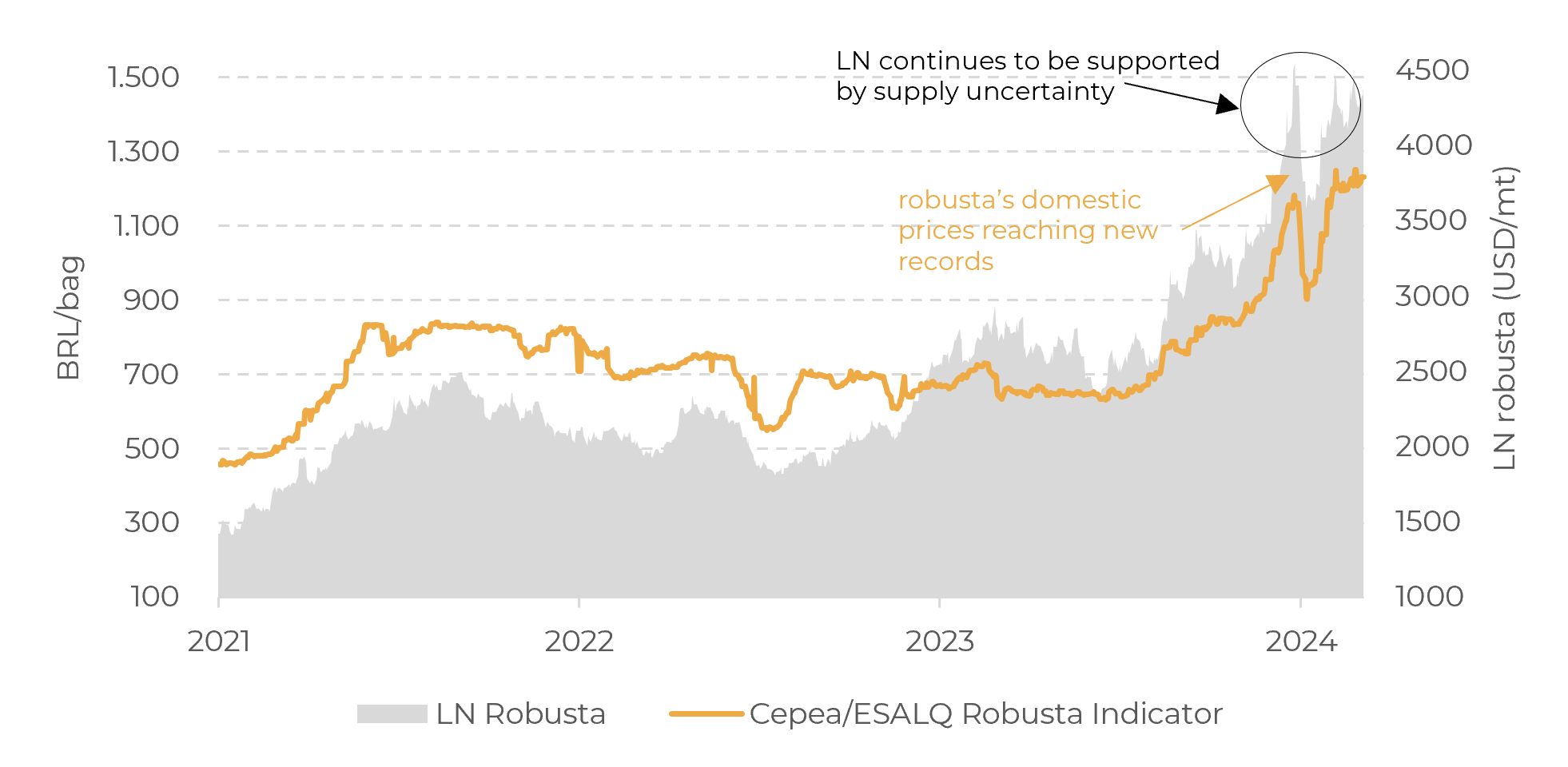

- However, as the harvest progresses, Brazilian domestic prices are also rising, which is not such a common move as we would normally see selling pressure at this time.

- While NY and LN prices did have some correction from April’s peak, domestic prices in Brazil are reaching new records. June’s monthly average of the Cepea/Esalq robusta Indicator reached BRL 1.214,24/bag, a new record-high. The average price of the Arabica Indicator in June also reached its highest level since February 2022.

- The uncertainty of the supply in 24/25, especially on the robusta side, continues to be the main support for prices. The expectation of another season of tight supply is also leading producers to hold their beans, boosting domestic prices in Brazil.

Brazil's 24/25 harvest reaches 58%, yet domestic prices continue to reach higher levels

This Friday, Safras & Mercado’s report showed that the 24/25 coffee harvest had already reached 58% in the first week of July, surpassing the 54% average levels of the last five seasons for the period. Arabica’s harvest was estimated at 50%, above the five-year average of 45%, while robusta’s crop progress reached 76%, also higher than the 73% average. Dry weather conditions in all Brazilian coffee regions continue to favor harvest progress and bean processing.

Given this current scenario, one would expect that prices would give in to the expected increase of coffee on the market, right? However, this is not completely reflected in the market at the moment.

While NY and LN contracts have indeed fallen from April's price peak, they remain overall supported. On the Brazilian domestic market, on the other hand, prices are soaring: Cepea/Esalq Arabica Coffee Indicator closed June with an average of BRL 1,349.21/bag, up 15% from May’s average and the highest since February 2022. Meanwhile, the robusta Indicator had an average of BRL 1.214,24/bag, up 20,6% from the previous month and a record-high monthly average for the indicator. On June 24th, the robusta indicator also reached the highest value in Cepea price history, at BRL 1,250.67/bag

Arabica Harvest – Historical (% of total)

Source: Safras & Mercado

Robusta Harvest – Historical (% of total)

Source: Safras & Mercado

The main reason that prices remain supported, despite the advance of the harvest in Brazil, continues to be the global uncertainty over the 24/25 season, specially regarding the robusta crop. As we mentioned in our previous report, in Vietnam, there is no guarantee that the return of rains from May onwards will offset the dry and hot weather from the beginning of 2024, which may lead to another season of robusta deficit. This has also led to an increase in demand for the Brazilian robusta.

On the other hand, in Brazil, recent crop reports continue to point to screen size issues and concerns over 24/25 yields (for both arabica and robusta), although many regions have seen an improvement since the start of the crop. This is also fueling perspectives by part of the market of a smaller crop in Brazil and leading producers to hold their beans, which is, in hand, also boosting domestic prices.

For now, our expectations are still for a production close to 23/24 levels in Brazil, with arabica production around 45 M bags and robusta close to 22 M bags. Nevertheless, if the current scenario doesn't show any improvement in the coming weeks, we may revise our numbers.

Another point of attention in coming months is the development of the 24/25 season in Central America and Mexico. Many countries in the region also suffered a dry spell since in 2023 and the start of 2024 which might affect the production. In Mexico (the most affected country) for example, many producers expect a drop in production even with the return of rains in May. The hurricane season of the region also started early this year and should be monitored for potential impact on coffee areas.

Arabica - Brazilian Prices (BRL/bag) and NY Contracts (c/lb)

Source: Cepea, Refinitiv

Robusta - Brazilian Prices (BRL/bag) and LN Contracts (USD/mt)

Source: Cepea, Refinitiv

In Summary

With the current dry conditions in Brazil, the 24/25 coffee harvest is progressing faster than in previous years. However, even with 50% of the crop harvested in Brazil, domestic prices continue to rise, especially the robusta, with the Cepea/Esalq robusta indicator hitting new records last week.

Overall, prices are supported by the uncertainty of the 24/25 global robusta production due to adverse weather conditions between 2023 and 2024, especially in Vietnam. However, there are also some concerns about a slight reduction in the Brazilian crop of arabica and robusta and doubts about the production of washed Arabica beans in Central America and Mexico, given the extreme weather conditions until April and the impact of the hurricane season in 24/25.

On the other hand, it is good to remember that any change in this view on the 24/25 season could affect prices in the short term, as speculative positions remain high, and a more positive outlook could trigger a sell-off.

Weekly Report — Coffee

Written by Laleska Moda

laleska.moda@hedgepointglobal.com

Reviewed by Natalia Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil)

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.