What if Center-South has less cane? Let's test it!

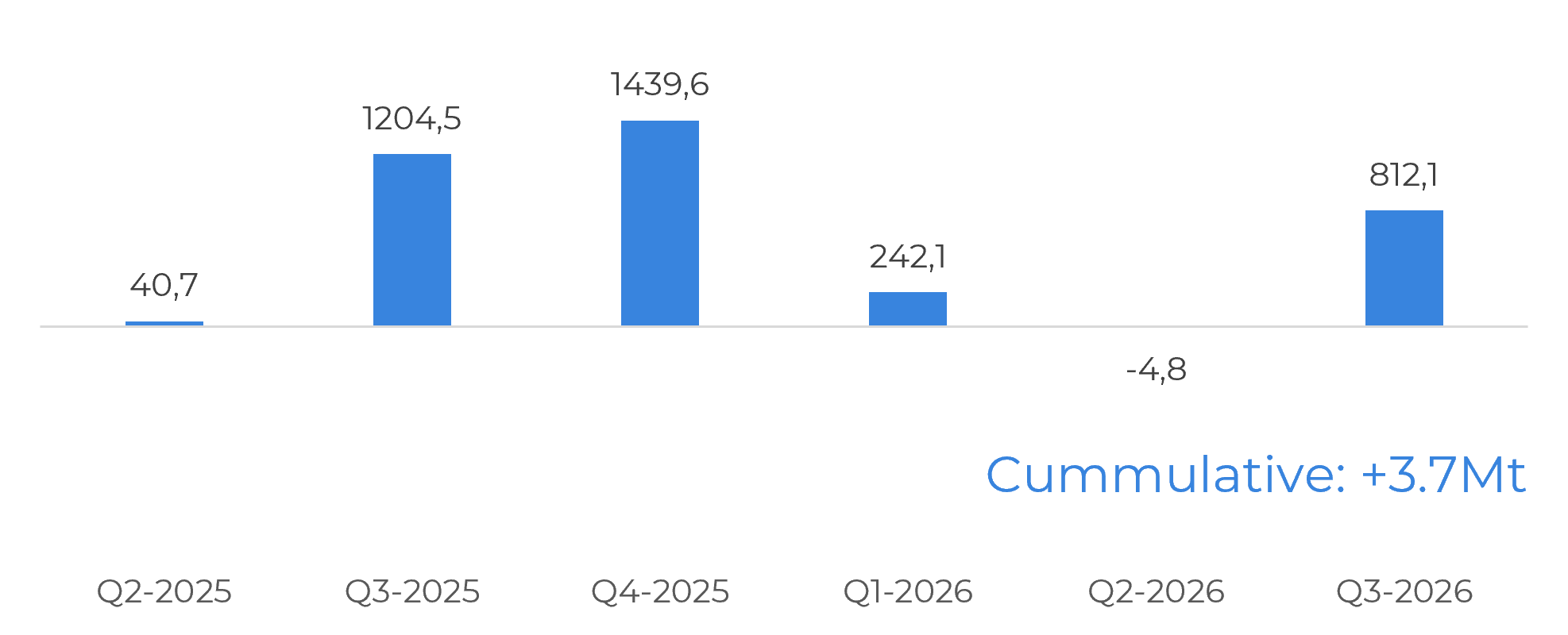

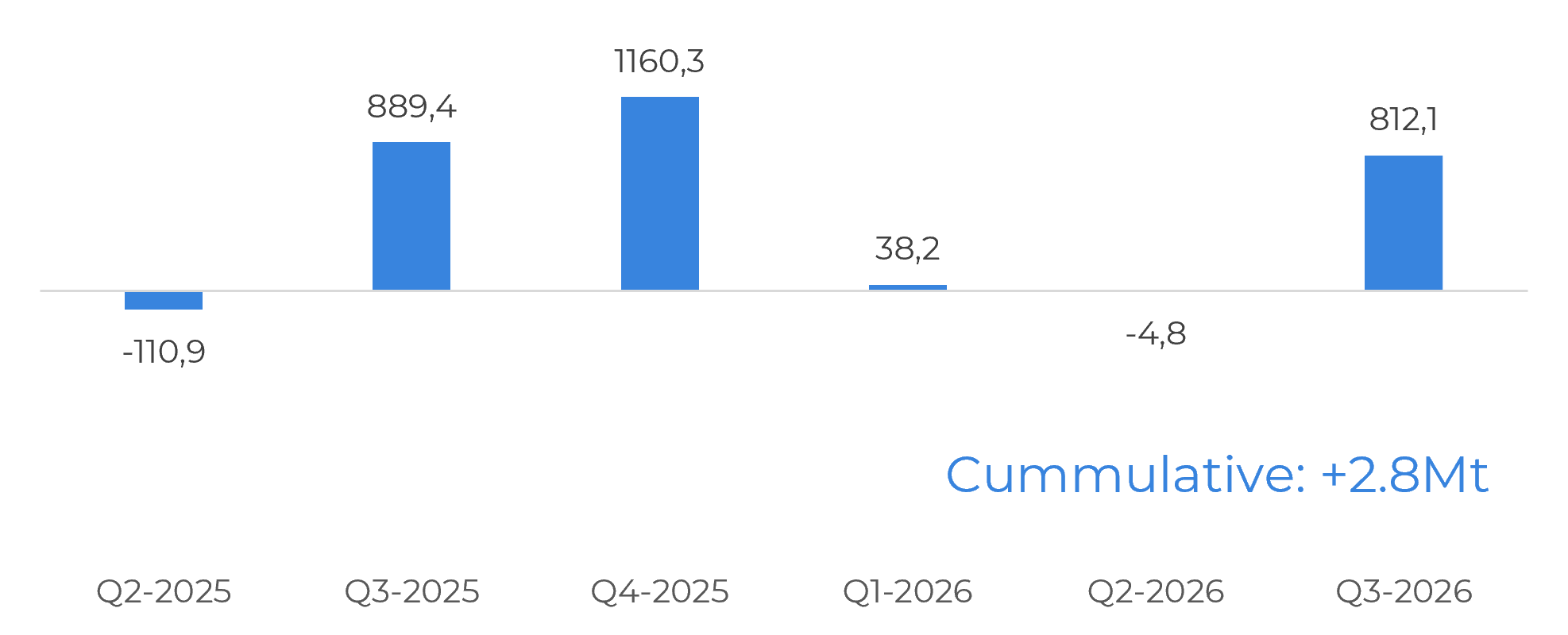

"We remain cautious, awaiting May yield data before revising cane volume estimates, currently at 620 Mt. A potential reduction to 605 Mt would tighten the trade surplus and support a more bullish outlook, though a major price rally would likely require a much steeper drop in cane availability."

What if Center-South has less cane? Let's test it!

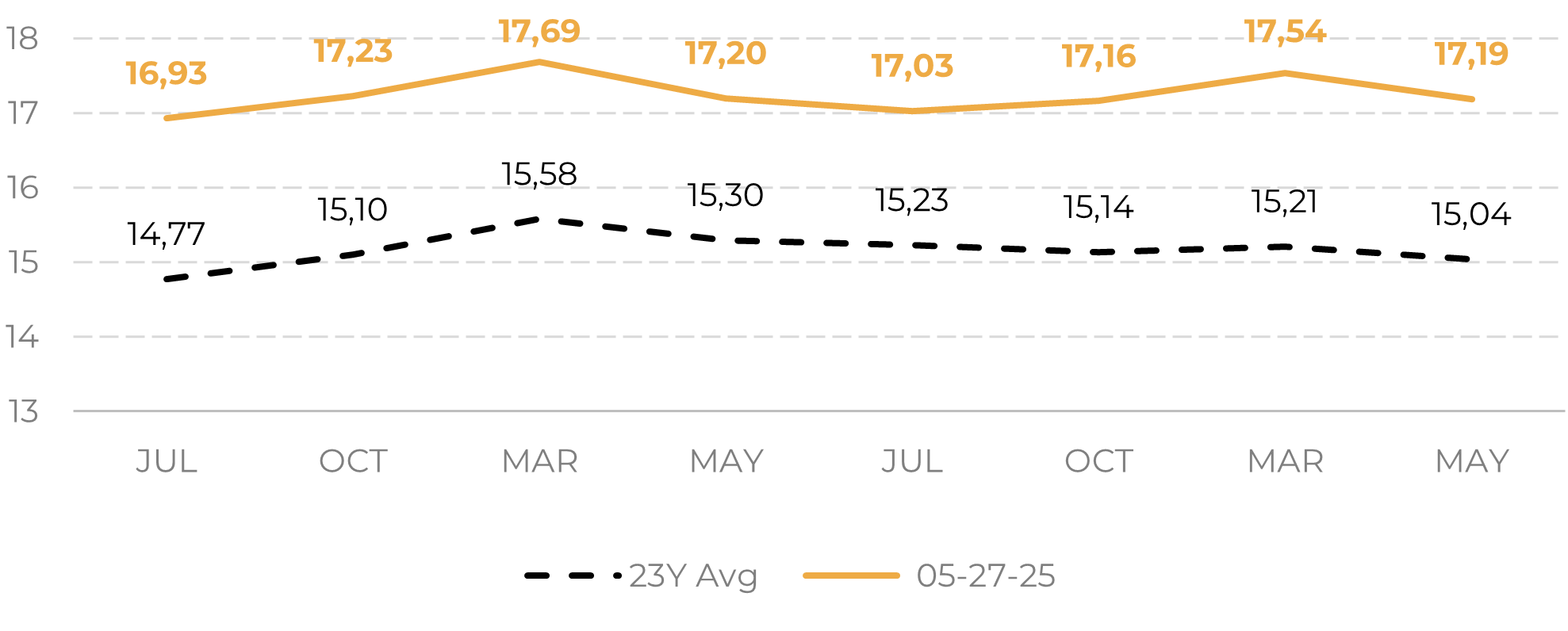

- Raw sugar prices rebounded slightly after Unica’s mid-May report, which showed strong crushing volumes but left uncertainty about crop health.

- The cumulative crushing gap from 25/26 versus last season widened to nearly 20 Mt, largely due to April/25 delays and leftover cane boosting early 24/25 figures.

- TRS remained 5% below last year, but a record-high sugar mix (51.2%) helped ease concerns about cane quality, with prices failing to sustain their gains.

- A potential 15 Mt reduction in our estimates of cane volume could cut sugar output by 1 Mt, tightening the trade surplus and supporting a more bullish price outlook, but not comparable to levels seen in years of deficit.

- A major price rally would require a much steeper drop in cane availability.

Raw sugar prices regained some ground by the end of last week following Unica’s first half of May results release. The report was somewhat ambiguous, sparking debate about whether it provided enough insight into the crop’s overall health to justify further revisions.

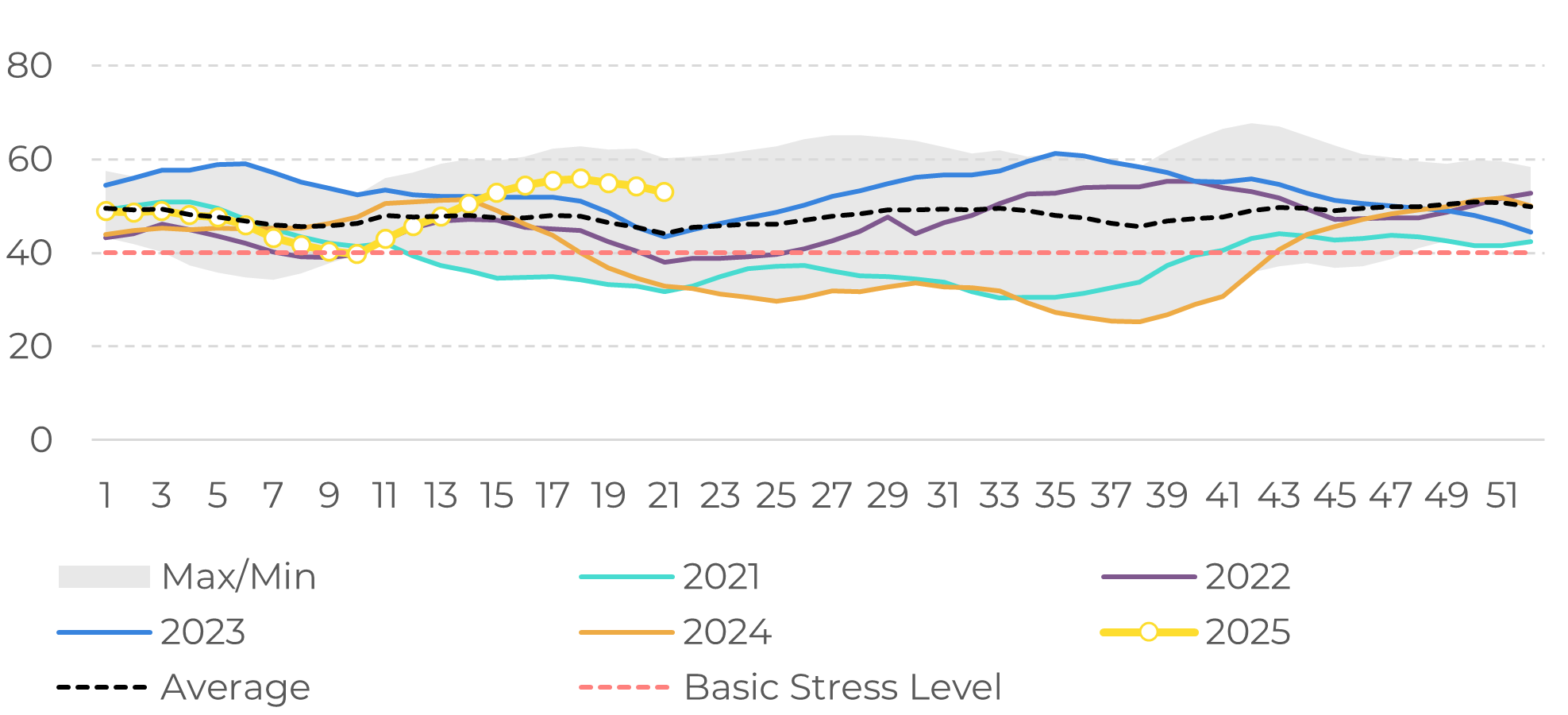

Crushing reached 42.3 Mt, exceeding the 5-year average of 41.5 Mt, but still behind the 24/25 season. The cumulative gap widened to nearly 20 Mt, with 76.7 Mt crushed so far compared to 96.2 Mt during the same period last year. However, two key factors should not be overlooked. First, most of this shortfall stems from the second half of April, which experienced the highest number of estimated lost days for that period. Second, the early part of the 24/25 season benefited from an unusually high volume of leftover cane from 23/24.

Total Recoverable Sugar (TRS) supported a bullish tone, remaining approximately 5% below last year’s levels. On the other hand, the sugar mix gave bears some relief, hitting a record-high (over 51%) for the fortnight and easing concerns about cane quality in terms of sugar content (reducing sugars).

As a result, the market’s reaction was mixed. While April’s yield figures remain the most concerning, the report itself offered little new information on that front. Before making any significant adjustments to cane volume estimates, the market will likely wait for additional data.

Image 1: Raw Sugar's Historical Future Curve Comparison (USc/lb)

Source: LSEG, Hedgepoint

Image 2: CS Estimated Vegetation Health Index

Source: NOAA, Hedgepoint

Image 3: Total Trade Flows – Base Case With 620Mt of cane

Source: Green Pool, Hedgepoint

Image 4: Total Trade Flows – Stressed Scenario With 605Mt of cane

Source: Green Pool, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.