When Demand Whispers and Supply Roars

"Sugar prices held steady this week after retreating from recent highs, with early momentum driven by demand signals from Pakistan, China, and the U.S. Despite some fund support, market sentiment remains bearish, reinforced by strong production expectations in Brazil and the Northern Hemisphere. Brazil’s Center-South yields suggest a more robust cane volume, supporting our 605Mt estimate, and UNICA’s record-high sugar mix of 54% in late July narrowed the production gap. Meanwhile, the potential Indian exports add to global supply pressure. Although factors like weather disruptions, macro stability, and ethanol stock levels could offer support, most of them remain speculative, leaving trade flows tilted toward a surplus and continued price softness."

When Demand Whispers and Supply Roars

- Sugar prices held steady after a recent peak, driven by demand signals from Pakistan, China, and the U.S., but lacked fundamental support.

- Market sentiment remains bearish, with strong production expected in Brazil and the Northern Hemisphere.

- Recently released Center-South yields support a higher cane volume estimate than the market’s average.

- UNICA reported a record 54% sugar mix in late July, helping narrow Brazil’s production gap compared to 24/25 and reinforcing robust supply.

- While factors like weather disruptions, macro stability, and tight ethanol stocks could offer support going forward, they remain speculative and unconfirmed.

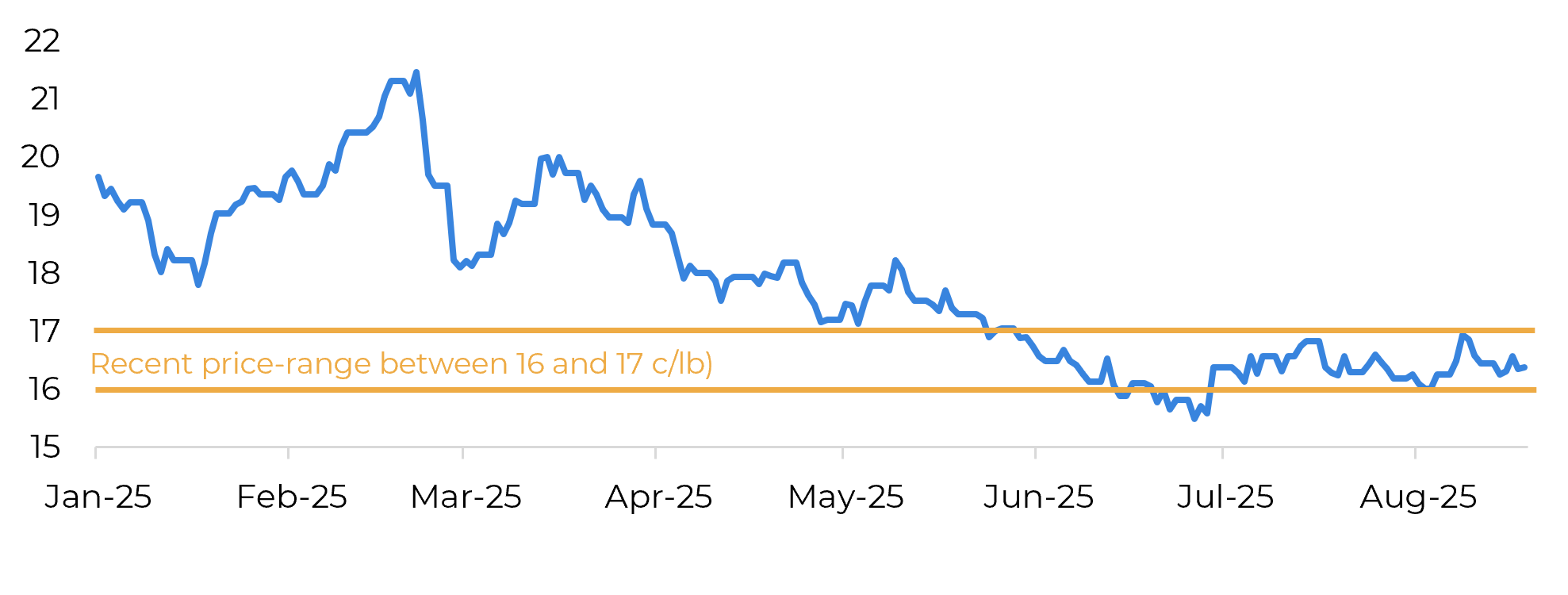

Sugar prices remained relatively stable throughout the week, following a retreat from their highest levels in two months the week prior. Initial momentum was driven by strengthening demand signals – such as tenders in Pakistan, increased Chinese imports reported by customs, and speculation around sugarcane use in Coca-Cola production in the U.S. However, the sweetener lost traction as no significant changes to market fundamentals materialized.

NY No 11 (c/lb)

Source: Bloomberg, Hedgepoint

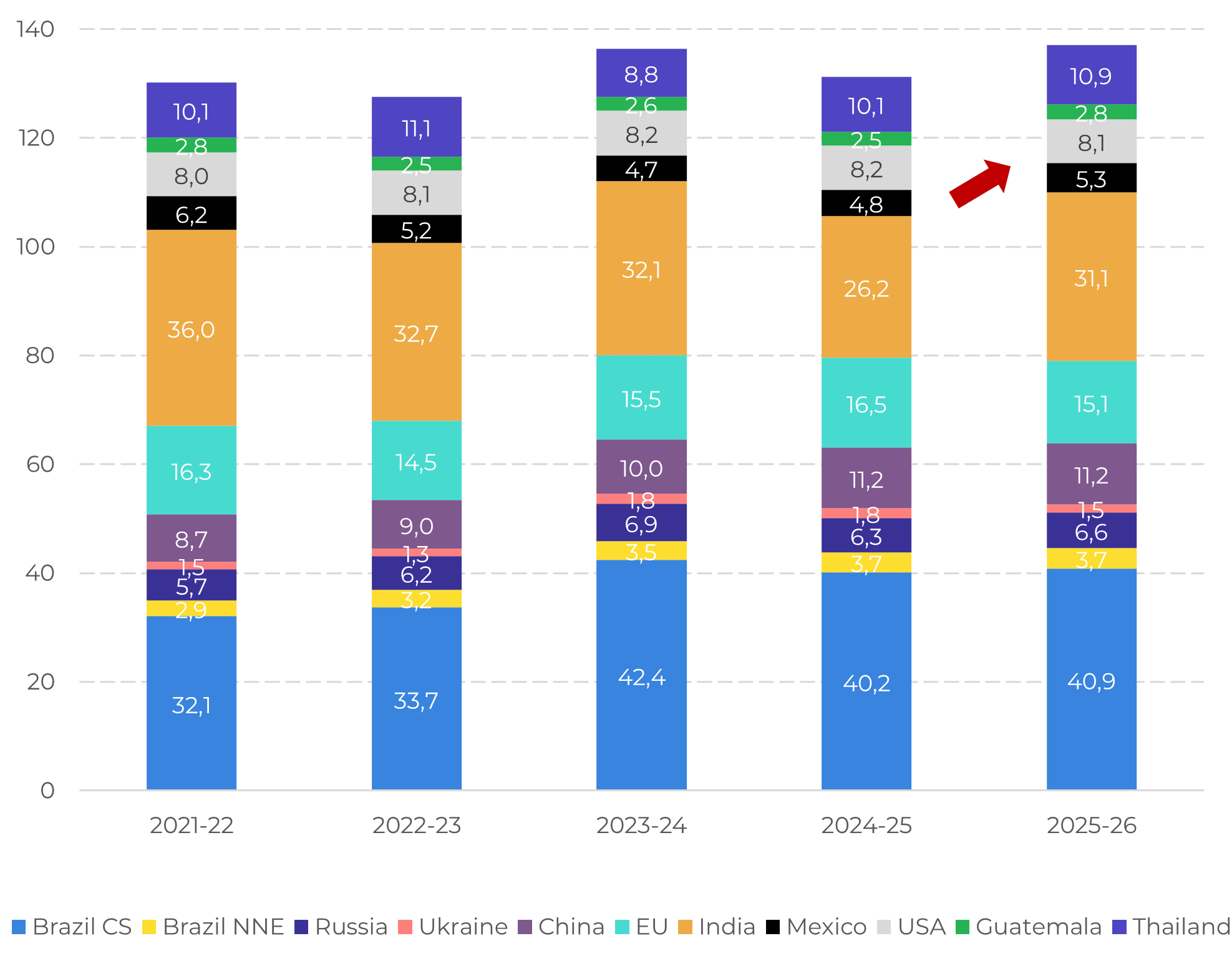

Key Countries Supply Growth (Mttq Crop-Year)

Source: Hedgepoint

It’s important to highlight that, although the current result is 6% below the same period last year, July peaks in TCH are historically uncommon – recently observed only in the 2023/24, 2022/23 and 2012/13 seasons. The last two presented a higher percentage of crushing happening after July. These crops 2022/23 and 2012/13 were key references in our previous report (link), as they were selected to help estimate our TCH curve due to their VHI trends closely resembling those seen so far in the 2025/26 season.

Therefore, sugar availability in Brazil is expected to remain strong, particularly due to the elevated sugar mix levels. The latest UNICA report recorded another all-time high, with a 54% mix during the second half of July. Despite being paired with a lower TRS, the fortnight’s sugar output of 3.6 Mt helped narrow the production gap, from 9.2% to 7.7% between reporting periods and compared to 24/25.

Additional price-pressure comes from increased Northern Hemisphere’s availability, as previously mentioned, particularly from countries like India, where export volumes could rise substantially depending on government decisions – note that 2 Mt export quotas have already been requested. This reinforces that prices might still be stuck at current levels for a while, receiving support from the demand side, especially China.

China is expected to bring in more sugar than previously anticipated, despite strong domestic production and positive prospects for 2025/26. The Ministry of Agriculture revised its 2024/25 import forecast from 4.75Mt to 5Mt. Our current estimate includes 4.6Mt of raw sugar and at least 1Mt of syrup in sugar equivalent.

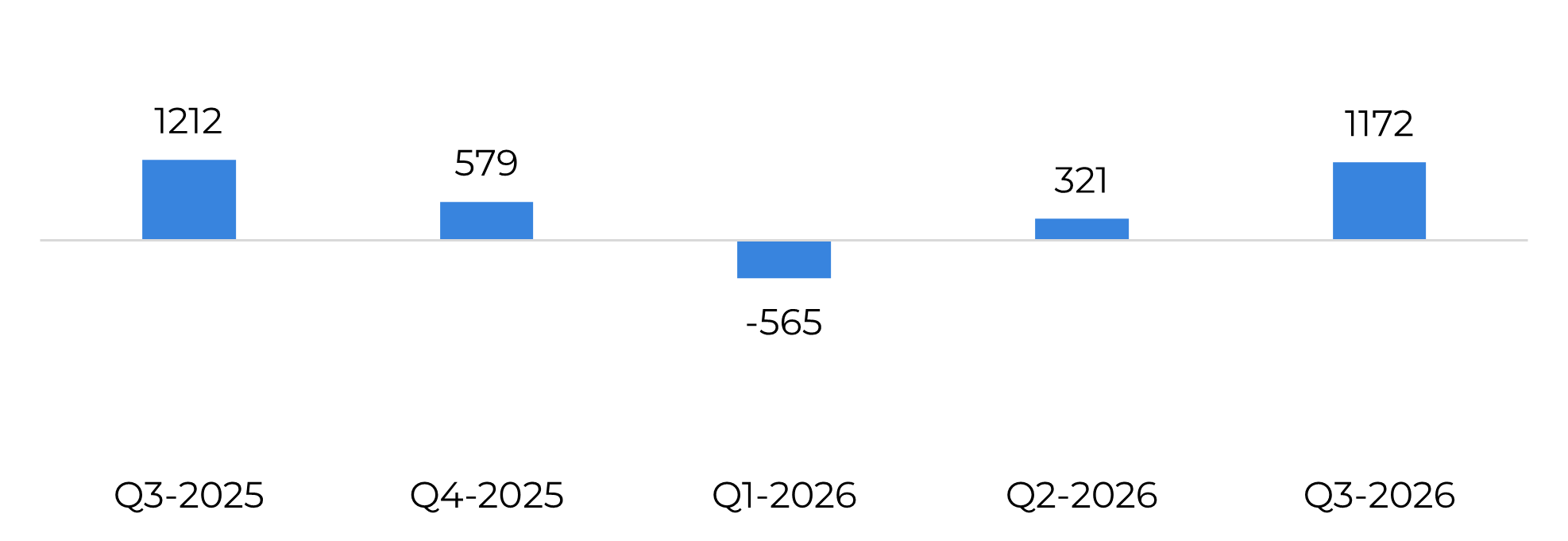

Despite this increase in imports, as mentioned before, supply is still suficient, with trade flows expected to remain bearish with a projected surplus exceeding 2.5 Mt between Q3 2025 and Q3 2026. While seasonal factors, such as Brazil’s intercrop period and low domestic ethanol stocks, may offer some price support, the surplus anticipated between Q3 and Q4 2025 is likely to dampen any significant recovery momentum possibly happening at the beginning of 2026, of course, ceteris paribus.

Total Trade Flow (‘000t)

Source: Green Pool, Hedgepoint

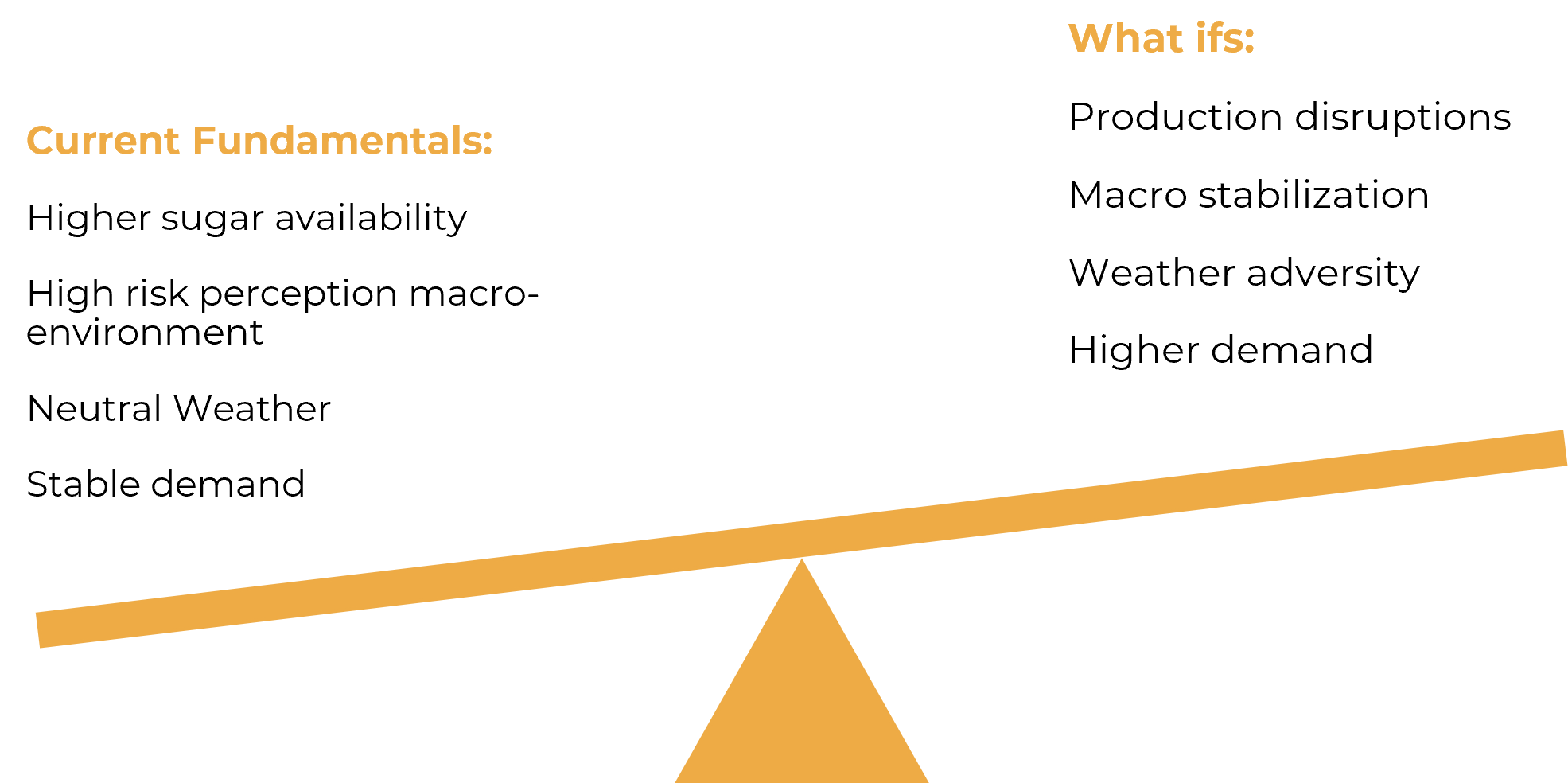

The key question now revolves around whether current bearish fundamentals will persist or begin to weaken, potentially paving the way for a shift in market sentiment. Several factors could influence this outlook; some can be listed:

- Production Disruptions: Adverse weather in the Northern Hemisphere could hinder mills from initiating or maintaining efficient crushing operations, delaying or limiting supply. In Brazil’s Center-South, the possibility of recurring fire incidents, similar to those seen in 2024, could also unexpectedly impact availability.

- Macro Sentiment Stabilization: A more stable macroeconomic environment may encourage investors to re-engage with riskier assets, potentially supporting market recovery.

- Demand Strengthening: China is expected to continue purchasing, as arbitrage opportunities remain open. Although destination stock levels are difficult to measure, the lingering effects of previous supply deficits could lead to sustained demand.

- Brazilian Ethanol: Given the lower stocks predicted for the season, the offseason might add price-support to the sweetener.

That said, these factors remain speculative and largely unconfirmed, making them more “what ifs” than reliable indicators of a bullish turn.

Current Fundamentals vs “What ifs”

Source: Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.