Sugar and Ethanol Weekly Report - 2024 06 10

"Global supply and demand dynamics for 24/25 are uncertain, but with Brazil's increased availability in 2024, it limits significant price rebounds in 2024, suggesting that the current uptrend in prices may be short-lived."

Short-lived uptrend

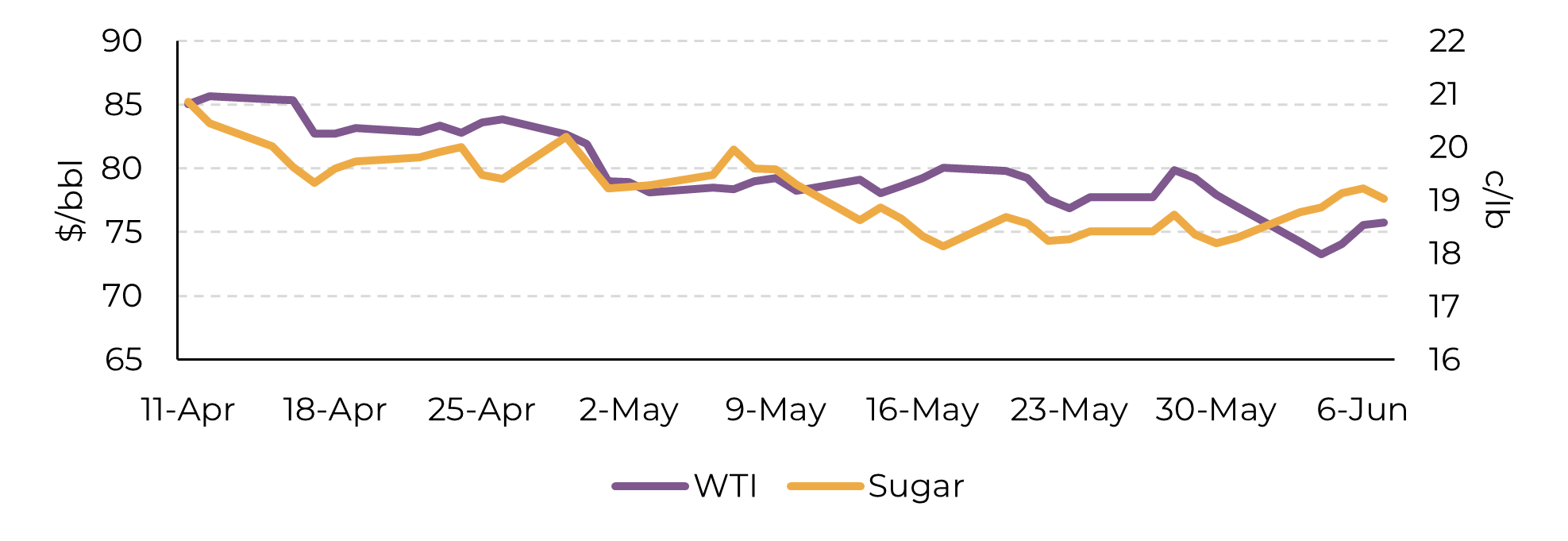

- Sugar prices increased due to technical factors despite challenges like a strong dollar and weak energy markets.

- Bullish sentiment was fueled by rumors of Chinese buying and lower-than-expected Brazilian sugar mix.

- Concerns remain over dry weather in Brazil's Center-South, mitigated by higher cane volume and TRS levels.

- Short- and medium-term fundamentals appear stable, with the 23/24 season anticipated to be surplus.

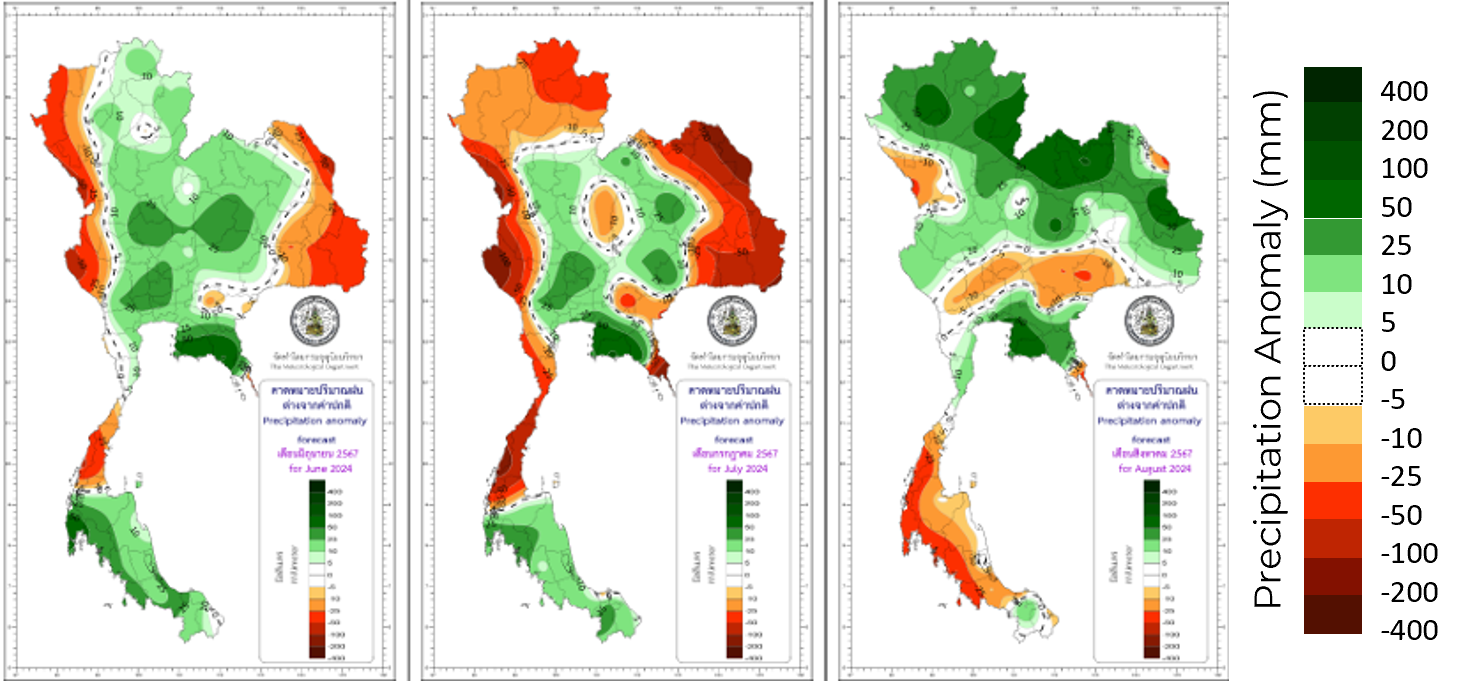

- Uncertainty looms for the 24/25 outlook, contingent on weather conditions, especially in India and Thailand.

- Brazil's increased sugar availability during 24/25 may limit significant price rebounds in the near term.

Sugar swiped up on a technical move last week. The sweetener’s resilience, considering the general framework of a stronger dollar - especially compared to BRL - and a weaker energy complex, enabled the July contract to breach the 19 c/lb level. Even though fundamentals didn’t change, some news were highly discussed.

Image 1: Sugar showed some resilience after the correction in the energy complex

Source: Refinitiv, Hedgepoint

While the latter is in line with a more bearish outlook, rumors regarding Chinese cash buying, although not entirely in line with current fundamentals, might have added to a more bullish sentiment. The fact that Brazilian sugar mix was lower than market’s expectations for May’s first fortnight also played a part in recent price action, especially when the market is still highly concerned about the dry spell that is currently affecting Center-South. However, there are some caveats.

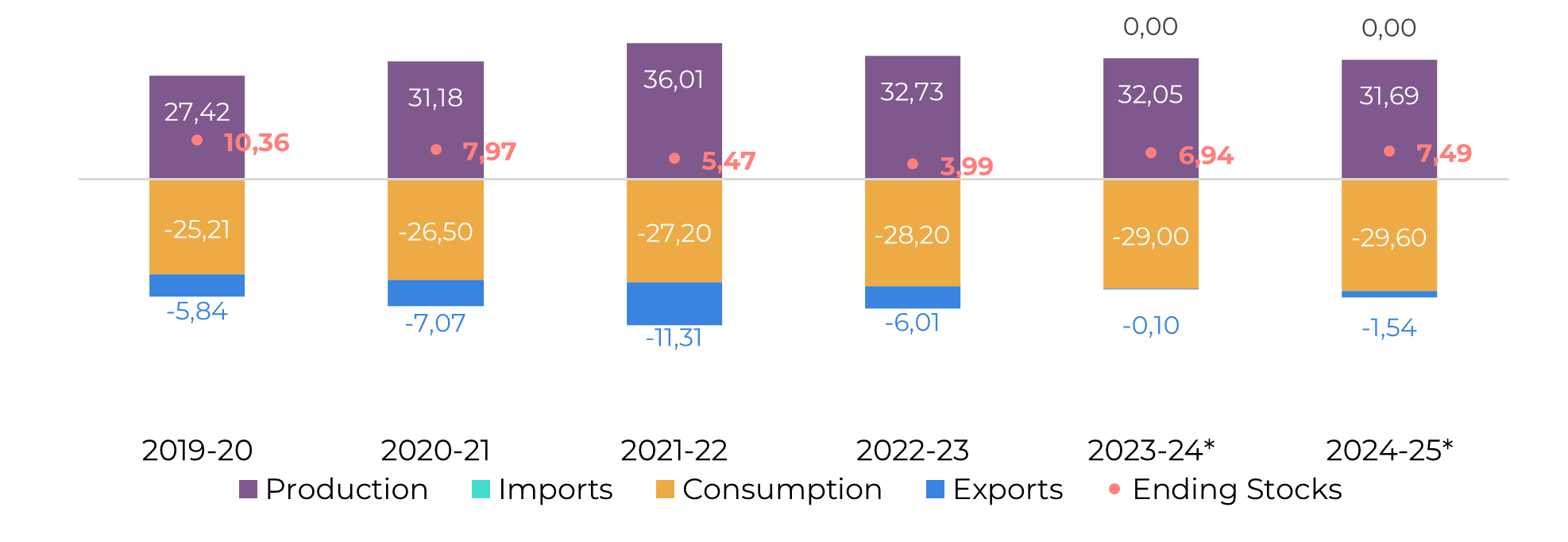

Image 2: India - Sugar Balance (Mt Oct-Sep)

Source: ISMA, AISTA, NFCSF, Hedgepoint

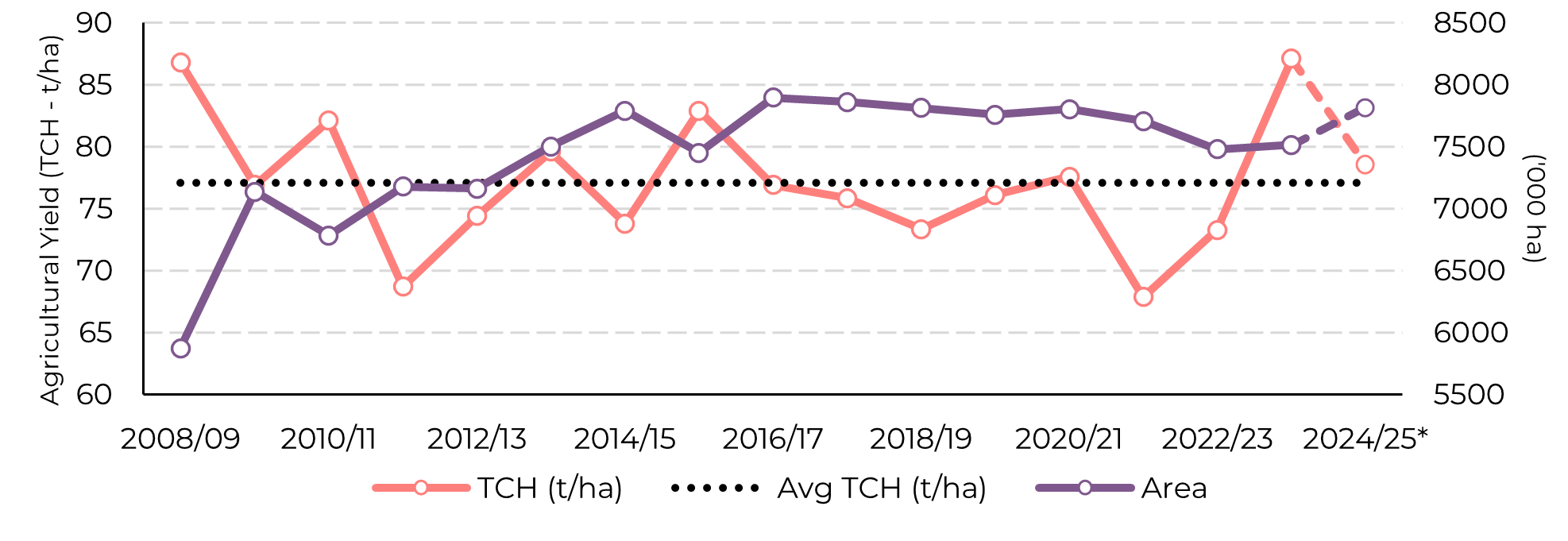

Consequently, the region is also expected to keep its export pace. May exports were approximately 17% higher year-on-year, with SECEX showing total shipments at 2.8Mt and Williams presenting a similar volume. With a stable cash premium at around +30 pts (June) and +17 pts (July), the country is currently the main source of sugar to the international market, which might explain mills' eagerness to keep pushing.

Image 3: Center-South Area and TCH evolution

Source: Unica, Conab, Hedgepoint

Therefore, short- and medium-term fundamentals haven’t changed much. The 23/24 Oct-Sep season should still be a surplus, reflecting a comfortable trade flow during 2024. The 24/25 year, however, is still highly dependent on weather, as discussed in previous reports. (If you want to know more about La Niña risks and effects, read our previous report.)

Although anticipated monsoons could boost India's cane production, certain stakeholders foresee a significant decrease in the country's yield due to area reduction. Nevertheless, given that cane proves to be a more profitable option for the average farmer and considering the government's willingness to address ethanol program's delays, we maintain a cautious stance toward this projected trend. Therefore, we have a higher expectation for India’s gross sugar production (37.2Mt), ethanol diversion (5.5Mt), and net results (31.7 Mt). Just a mental note: remember that the market was betting on 29Mt at the beginning of 23/24 and we are closer to 32Mt!

Regarding Thailand, we remain conservative at 10.5 Mt. While some houses point to a sugar production closer to 11.5Mt, uneven weather patterns and La Niña’s possible effects prevented us from revising it.

Image 4: Thailand precipitation anomaly forecast – June (left), July (center) and August (right) in mm

Source : Thai Meteorological Department

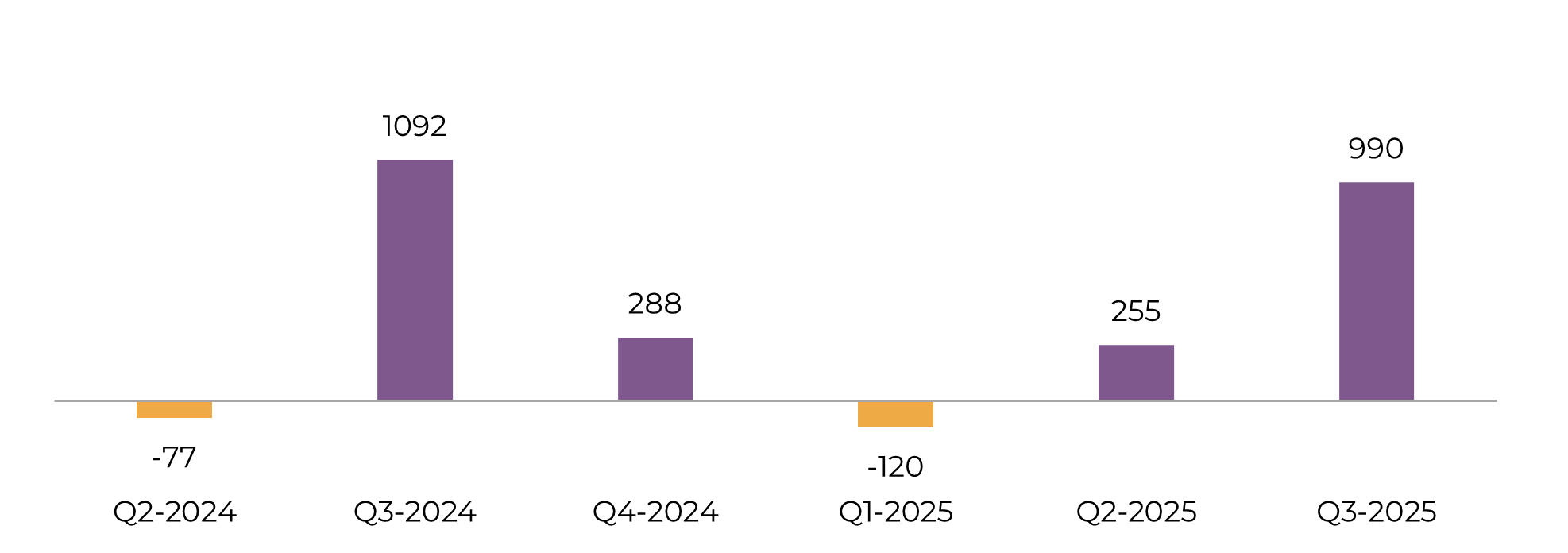

Image 5: Total Trade Flows ('000t tq)

Source: Green Pool, hEDGEpoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com